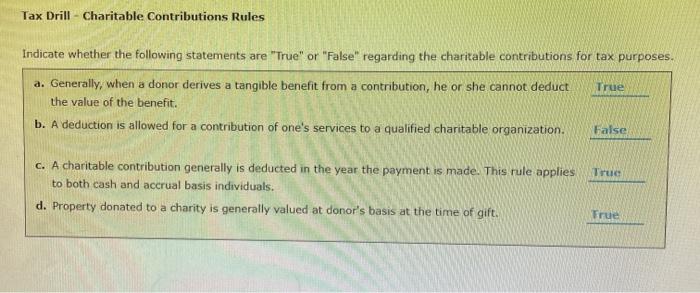

Question: 1. 2. are those correct? Tax Drill - Charitable Contributions Rules Indicate whether the following statements are True or False regarding the charitable contributions for

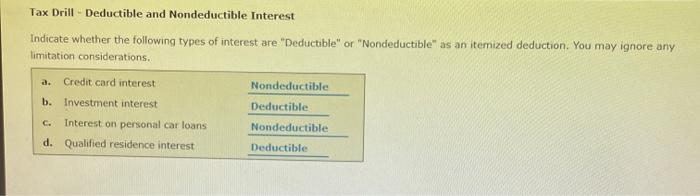

Tax Drill - Charitable Contributions Rules Indicate whether the following statements are "True" or "False" regarding the charitable contributions for tax purposes. True a. Generally, when a donor derives a tangible benefit from a contribution, he or she cannot deduct the value of the benefit. b. A deduction is allowed for a contribution of one's services to a qualified charitable organization. False True c. A charitable contribution generally is deducted in the year the payment is made. This rule applies to both cash and accrual basis individuals. d. Property donated to a charity is generally valued at donor's basis at the time of gift. True Tax Drill - Deductible and Nondeductible Interest Indicate whether the following types of interest are "Deductible" or "Nondeductible" as an itemized deduction. You may ignore any limitation considerations. a. Credit card interest Nondeductible Deductible b. Investment interest Interest on personal car loans d. Qualified residence interest C Nondeductible Deductible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts