Question: 1 - 2 - Ayayai Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,908,000 on

1 -  2 -

2 -

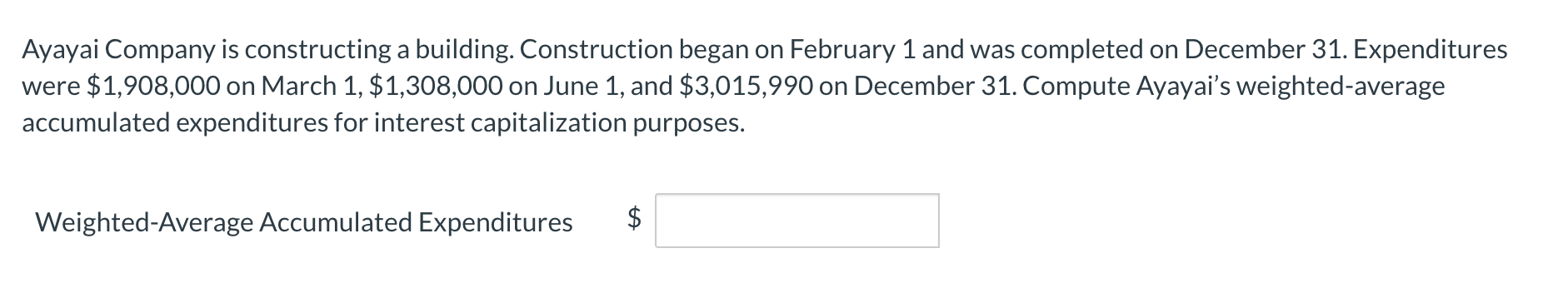

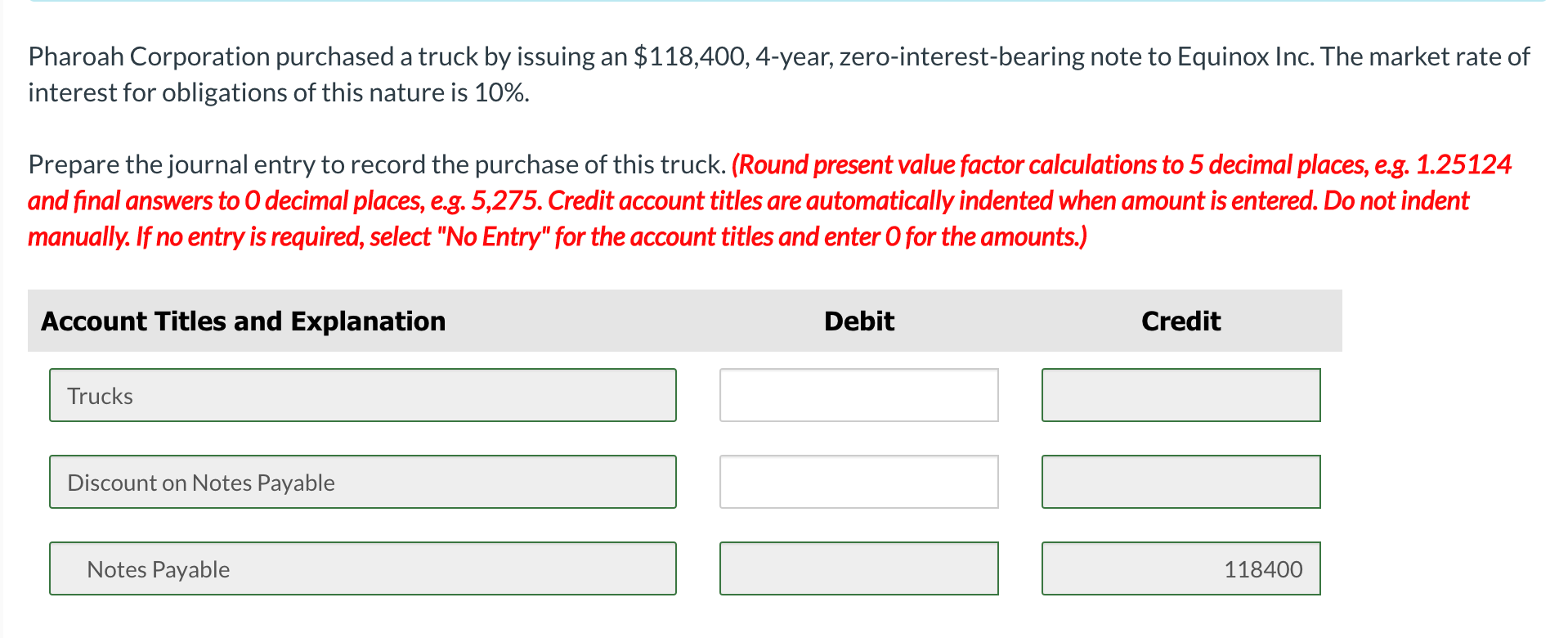

Ayayai Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,908,000 on March 1, $1,308,000 on June 1, and $3,015,990 on December 31. Compute Ayayai's weighted-average accumulated expenditures for interest capitalization purposes. Weighted-Average Accumulated Expenditures $ Pharoah Corporation purchased a truck by issuing an $118,400, 4-year, zero-interest-bearing note to Equinox Inc. The market rate of interest for obligations of this nature is 10%. Prepare the journal entry to record the purchase of this truck. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Trucks Discount on Notes Payable Notes Payable 118400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts