Question: 1. 2. Daily Enterprises is purchasing a $12,000,000 machine. The machine will be depreciated using straight-line depreciation over its 7 year life and will have

1.

2.

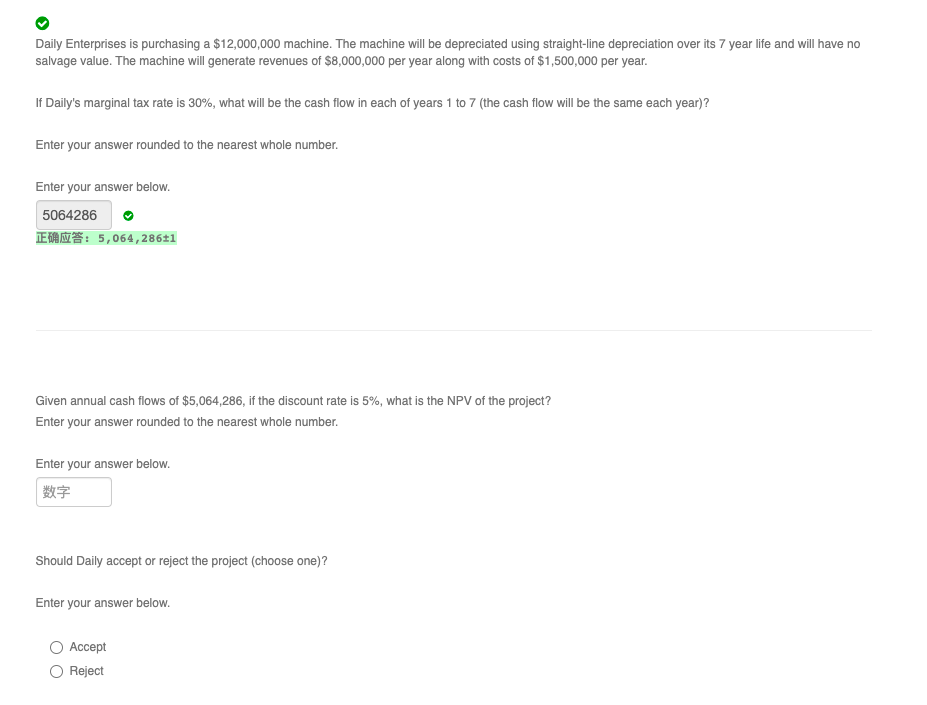

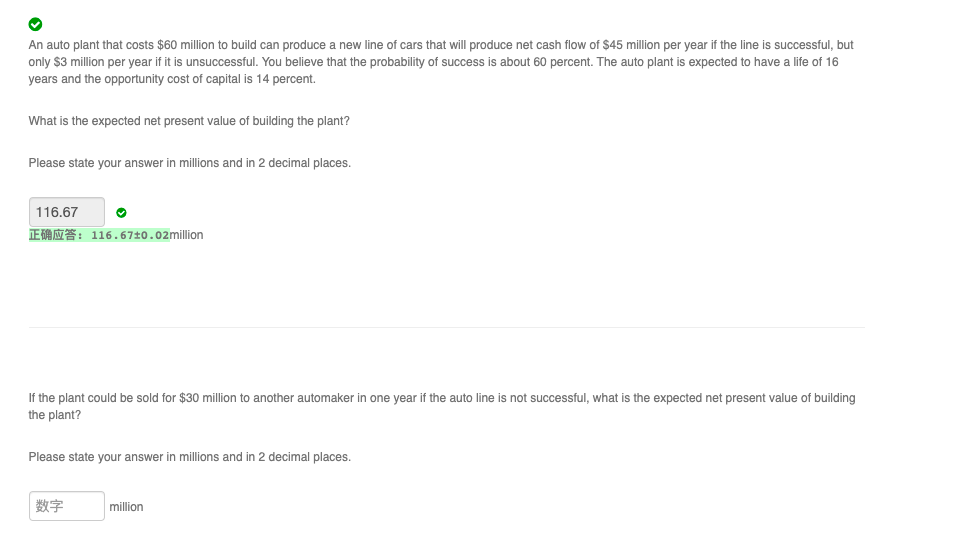

Daily Enterprises is purchasing a $12,000,000 machine. The machine will be depreciated using straight-line depreciation over its 7 year life and will have no salvage value. The machine will generate revenues of $8,000,000 per year along with costs of $1,500,000 per year. If Daily's marginal tax rate is 30%, what will be the cash flow in each of years 1 to 7 (the cash flow will be the same each year)? Enter your answer rounded to the nearest whole number. Enter your answer below. 5064286 : 5,064,28641 Given annual cash flows of $5,064,286, if the discount rate is 5%, what is the NPV of the project? Enter your answer rounded to the nearest whole number. Enter your answer below. Should Daily accept or reject the project (choose one)? Enter your answer below. Accept Reject An auto plant that costs $60 million to build can produce a new line of cars that will produce net cash flow of $45 million per year if the line is successful, but only $3 million per year if it is unsuccessful. You believe that the probability of success is about 60 percent. The auto plant is expected to have a life of 16 years and the opportunity cost of capital is 14 percent. What is the expected net present value of building the plant? Please state your answer in millions and in 2 decimal places. 116.67 TEAM: 116.670.02million If the plant could be sold for $30 million to another automaker in one year if the auto line is not successful, what is the expected net present value of building the plant? Please state your answer in millions and in 2 decimal places. million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts