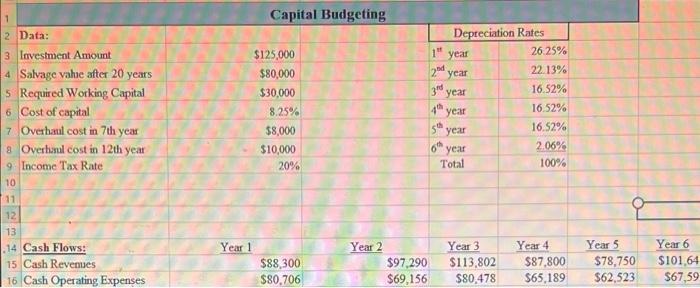

Question: 1 2 Data: 3 Investment Amount 4 Salvage value after 20 years 5 Required Working Capital 6 Cost of capital 7 Overhaul cost in 7th

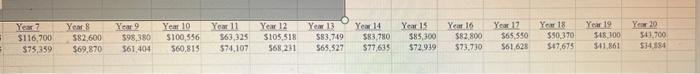

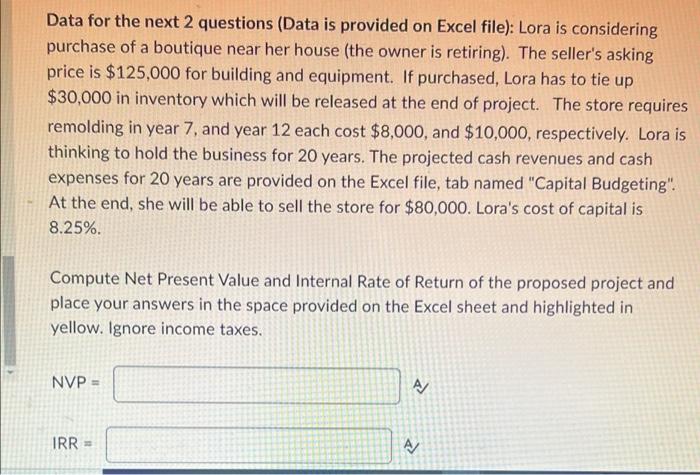

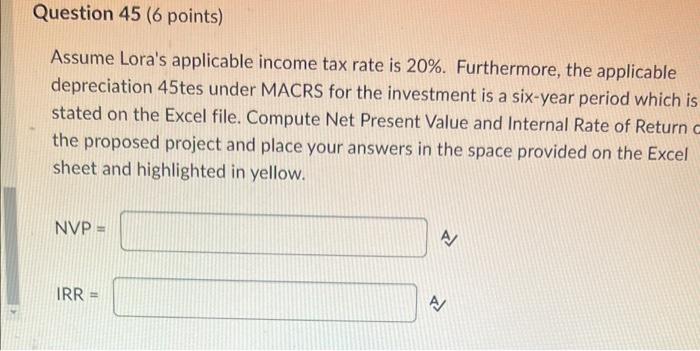

1 2 Data: 3 Investment Amount 4 Salvage value after 20 years 5 Required Working Capital 6 Cost of capital 7 Overhaul cost in 7th year 8 Overhaul cost in 12th year 1 9 Income Tax Rate 10 11 12 13 14 Cash Flows: 15 Cash Revenues 16 Cash Operating Expenses Year 1 Capital Budgeting $125,000 $80,000 $30,000 8.25% $8,000 $10,000 20% $88,300 $80,706 Year 2 1" year 2nd year 3rd year 4th year 5th $97,290 $69,156 Depreciation Rates 6% year year Total Year 3 $113,802 $80,478 26.25% 22.13% 16.52% 16.52% 16.52% 2.06% 100% Year 4 $87,800 $65,189 Year 5 $78,750 $62,523 Year 6 $101,64 $67,59 Year 7 $116,700 $75,359 Year 8 $82,600 $69,870 Year 9 $98,380 $61,404 Year 10 $100,556 $60,815 Year 11 363,325 $74,107 Year 12 $105,518 568,231 Year 13 Year 14 $83,749 $83,780 $65,527 $77,635 Year 15 Year 16 $85,300 $82,800 $72,939 $73,730 Year 17 $65,550 $61,628 Year 18 $50,370 $47,675 Year 19 $48,100 341,861 Year 20 $43,700 $34,884 Data for the next 2 questions (Data is provided on Excel file): Lora is considering purchase of a boutique near her house (the owner is retiring). The seller's asking price is $125,000 for building and equipment. If purchased, Lora has to tie up $30,000 in inventory which will be released at the end of project. The store requires remolding in year 7, and year 12 each cost $8,000, and $10,000, respectively. Lora is thinking to hold the business for 20 years. The projected cash revenues and cash expenses for 20 years are provided on the Excel file, tab named "Capital Budgeting". At the end, she will be able to sell the store for $80,000. Lora's cost of capital is 8.25%. Compute Net Present Value and Internal Rate of Return of the proposed project and place your answers in the space provided on the Excel sheet and highlighted in yellow. Ignore income taxes. NVP = IRR = A/ A/ Question 45 (6 points) Assume Lora's applicable income tax rate is 20%. Furthermore, the applicable depreciation 45tes under MACRS for the investment is a six-year period which is stated on the Excel file. Compute Net Present Value and Internal Rate of Return C the proposed project and place your answers in the space provided on the Excel sheet and highlighted in yellow. NVP = IRR = A/ A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts