Question: (1) (2) Discount factor table: Please show all workings. Assessment Details High PG Ltd is a production company with an average return on assets of

(1) (2)

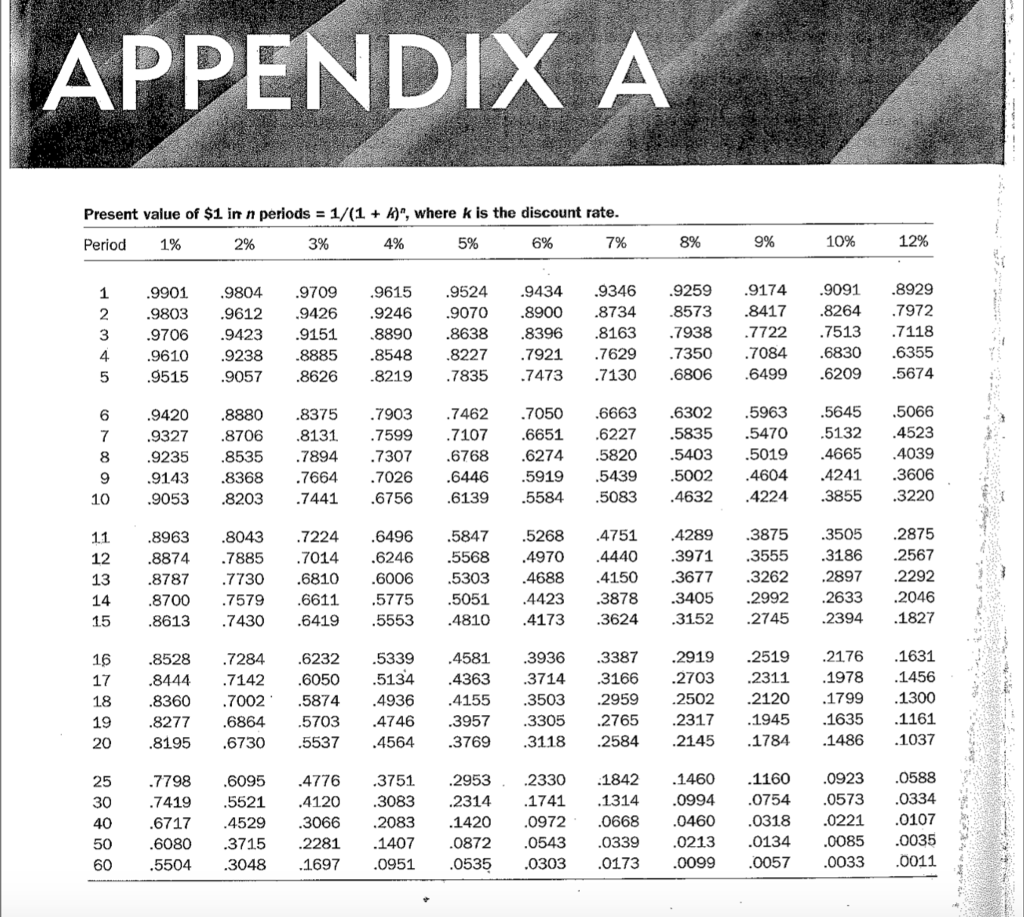

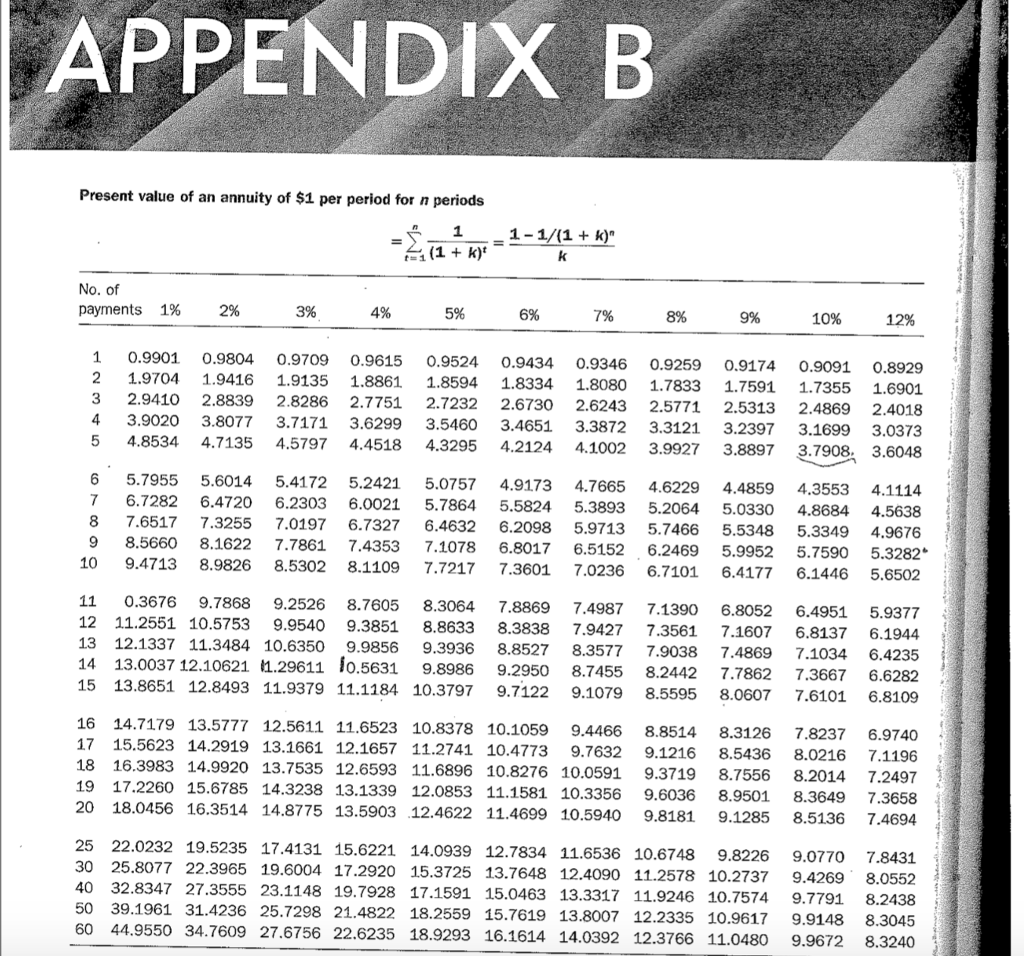

(2) Discount factor table:

Discount factor table:

Please show all workings.

Please show all workings.

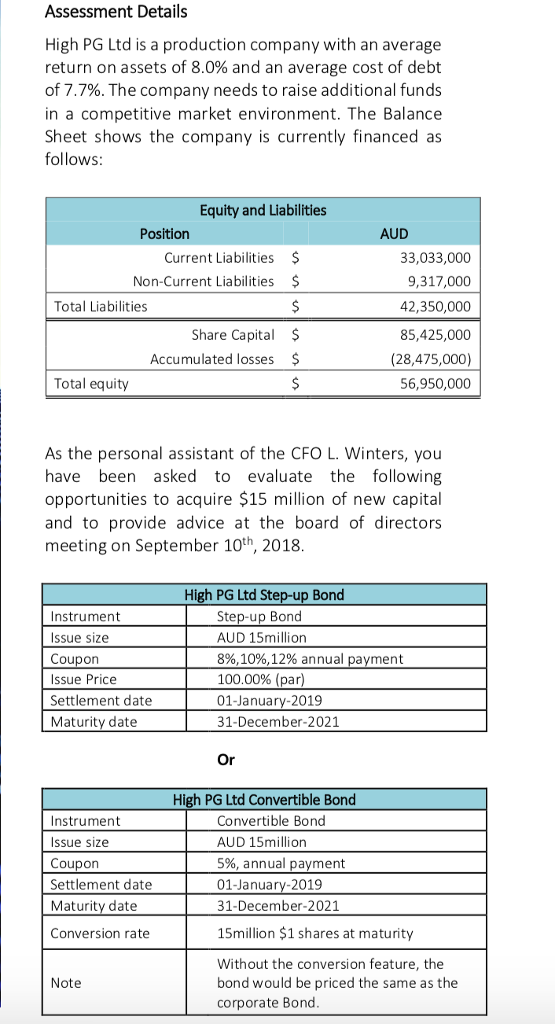

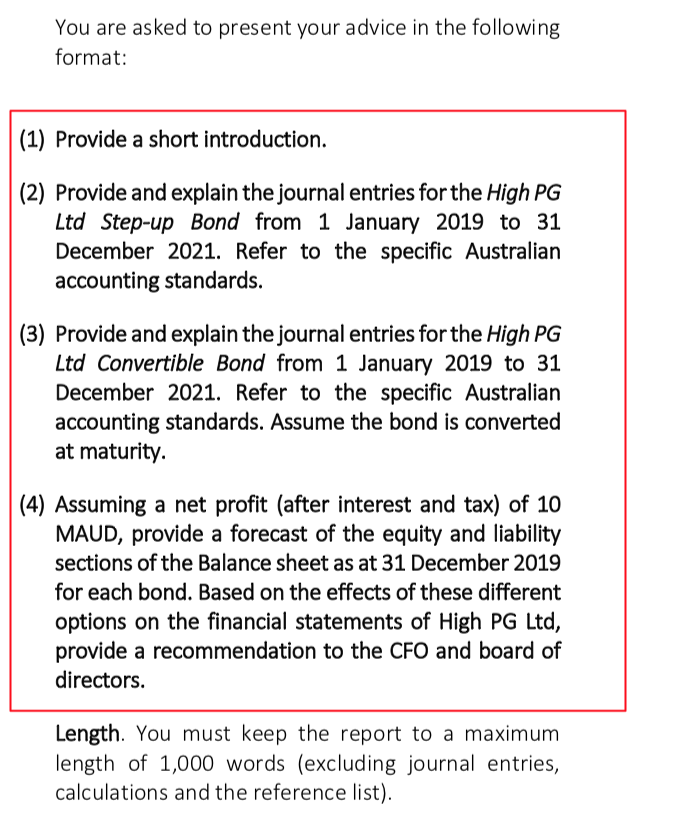

Assessment Details High PG Ltd is a production company with an average return on assets of 8.0% and an average cost of debt of 7.7%. The company needs to raise additional funds in a competitive market environment. The Balance Sheet shows the company is currently financed as follows: Equity and Liabilities Position AUD Current Liabilities $ Non-Current Liabilities $ 33,033,000 9,317,000 42,350,000 85,425,000 (28,475,000) 56,950,000 Total Liabilities Share Capital $ Accumulated losses $ Total equity As the personal assistant of the CFO L. Winters, you have been asked to evaluate the following opportunities to acquire $15 million of new capital and to provide advice at the board of directors meeting on September 10th, 2018 High PG Ltd Step-up Bond Instrument Issue size Coupon Issue Price Settlement date Maturity date Step-up Bond AUD 15million 8%,10%,12% annual payment 100.00% (par) 01-January-2019 31-December-2021 Or High PG Ltd Convertible Bond Instrument Issue size Coupon Settlement date Maturity date Conversion rate Convertible Bond AUD 15million 5%, annual payment 01-January-2019 31-December-2021 15million $1 shares at maturity Without the conversion feature, the bond would be priced the same as the corporate Bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts