Question: 1. 2. Enter the missing dollar amounts for the income statement for each of the following independent cases. (Hint: In Case B, work from the

1.  2.

2.

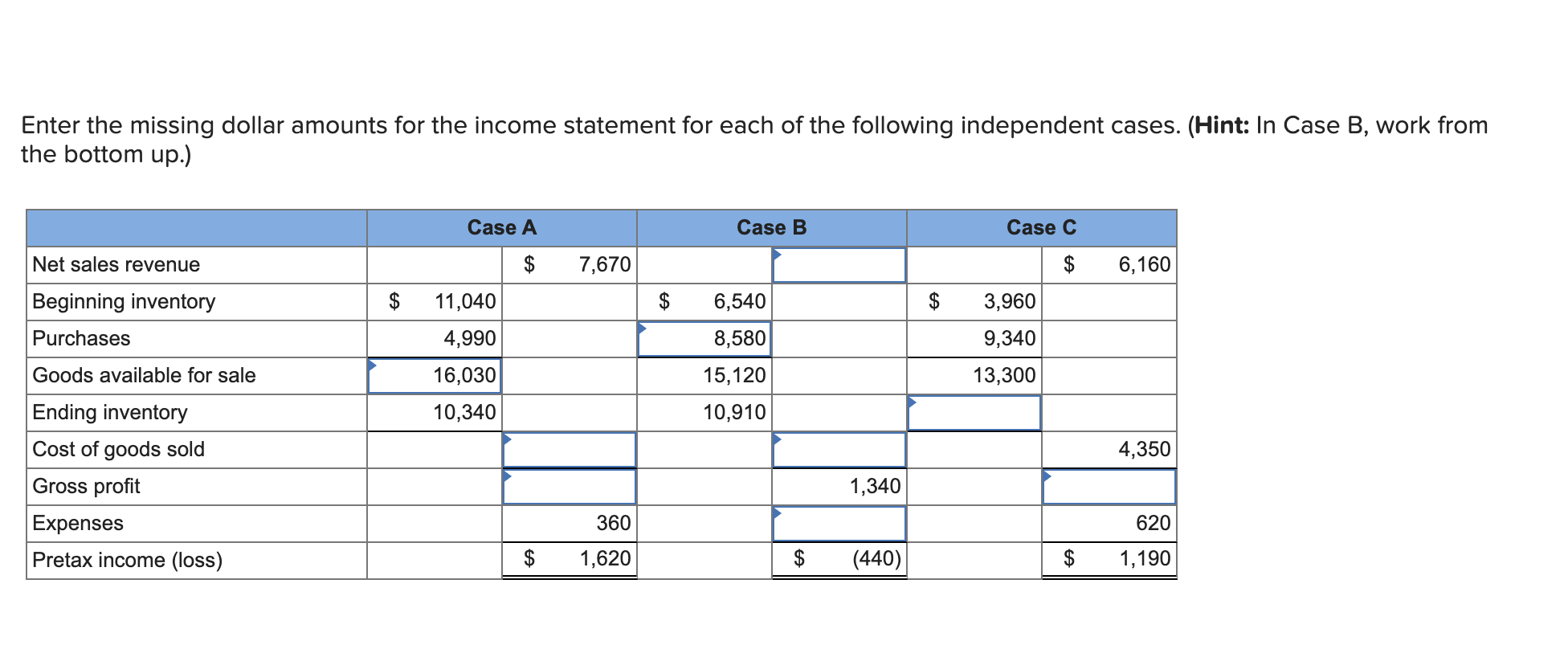

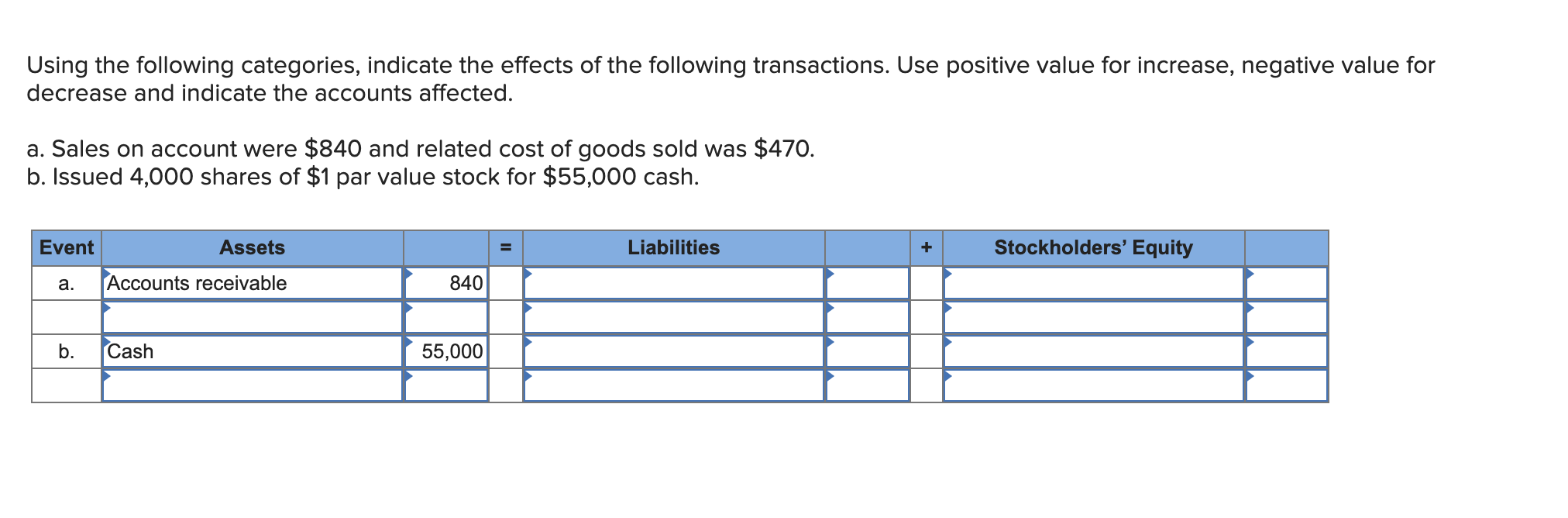

Enter the missing dollar amounts for the income statement for each of the following independent cases. (Hint: In Case B, work from the bottom up.) Case B Net sales revenue 6,160 7,670 | $ $ 6,540 $ Case A $ 11,040 4,990 16,030 10,340 Case C $ 3,960 9,340 13,300 8,580 15,120 10,910 Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold Gross profit Expenses Pretax income (loss) 4,350 1,340 620 360 1,620 $ | $ (440) | $ 1,190 Using the following categories, indicate the effects of the following transactions. Use positive value for increase, negative value for decrease and indicate the accounts affected. a. Sales on account were $840 and related cost of goods sold was $470. b. Issued 4,000 shares of $1 par value stock for $55,000 cash. Assets Liabilities Stockholders' Equi Event a. Accounts receivable 840 b Cash 55 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts