Question: 1. 2. please answer questions completely using multiple choice. Consider the following formula D D wacc E + E+D' 5'E E+D'D E+D'DC E D The

1.

2.

please answer questions completely using multiple choice.

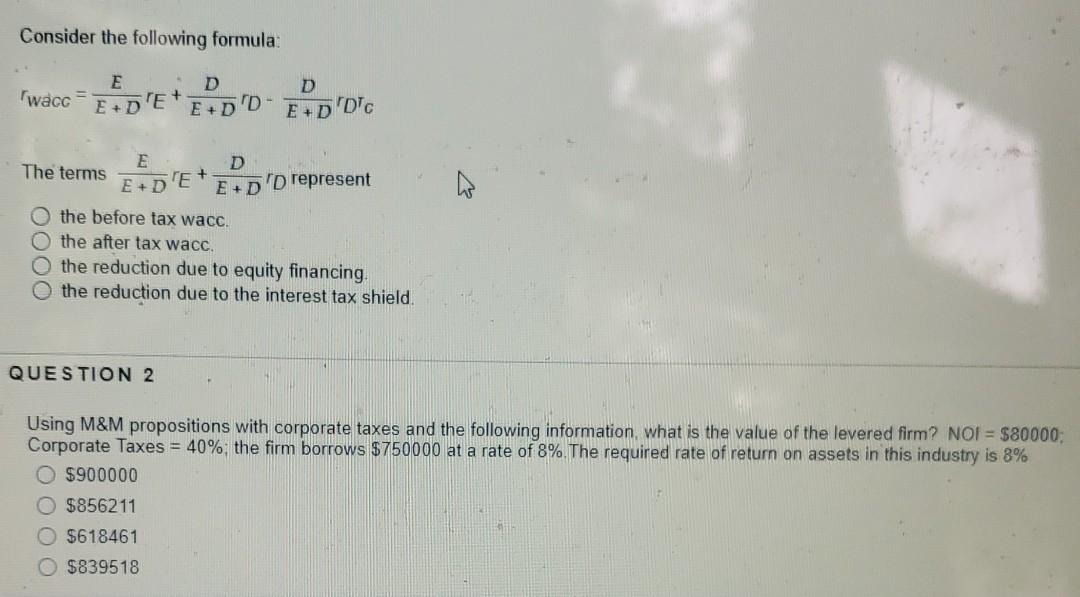

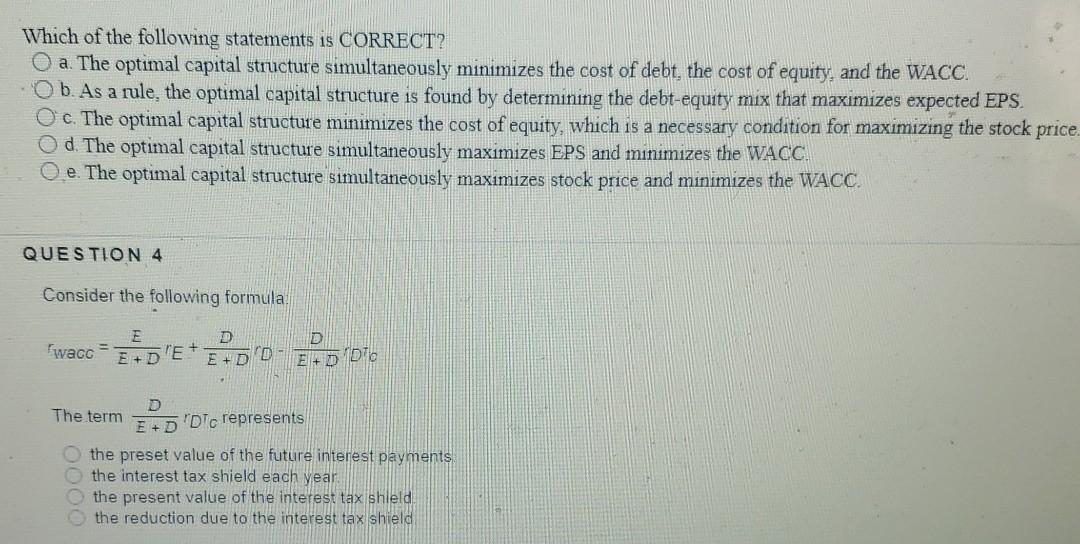

Consider the following formula D D wacc E + E+D' 5'E E+D'D E+D'DC E D The terms + E+D'E E+D'D represent the before tax wacc. the after tax wacc. the reduction due to equity financing the reduction due to the interest tax shield. QUESTION 2 Using M&M propositions with corporate taxes and the following information, what is the value of the levered firm? NOI = $80000; Corporate Taxes = 40% the firm borrows $750000 at a rate of 8%. The required rate of return on assets in this industry is 8% O $900000 O $856211 $618461 O $839518 Which of the following statements is CORRECT? O a. The optimal capital structure simultaneously minimizes the cost of debt, the cost of equity, and the WACC. O b. As a rule, the optimal capital structure is found by determining the debt-equity mix that maximizes expected EPS. O c. The optimal capital structure minimizes the cost of equity, which is a necessary condition for maximizing the stock price Od. The optimal capital structure simultaneously maximizes EPS and minimizes the WACC. e. The optimal capital structure simultaneously maximizes stock price and minimizes the WACC. QUESTION 4 Consider the following formula E wacc = D E + D E+DE+ D El Do The term D E+D "Dic represents the preset value of the future interest payments the interest tax shield each year, the present value of the interest tax shield the reduction due to the interest tax shield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts