Question: 1. 2. Please answer the right response for the wrong ones (the ones labelled X) Compute, Disaggregate and Interpret ROE and ROA Income statements for

1.

2.

Please answer the right response for the wrong ones (the ones labelled X)

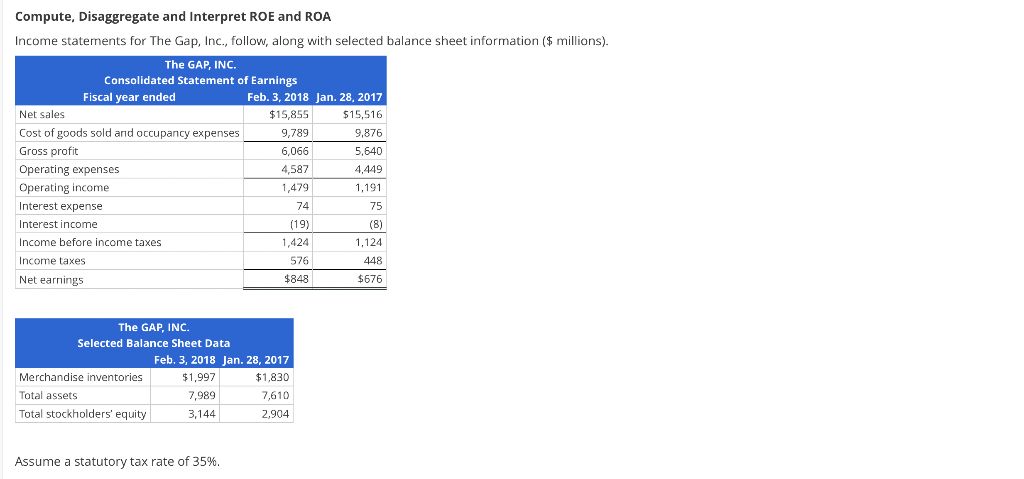

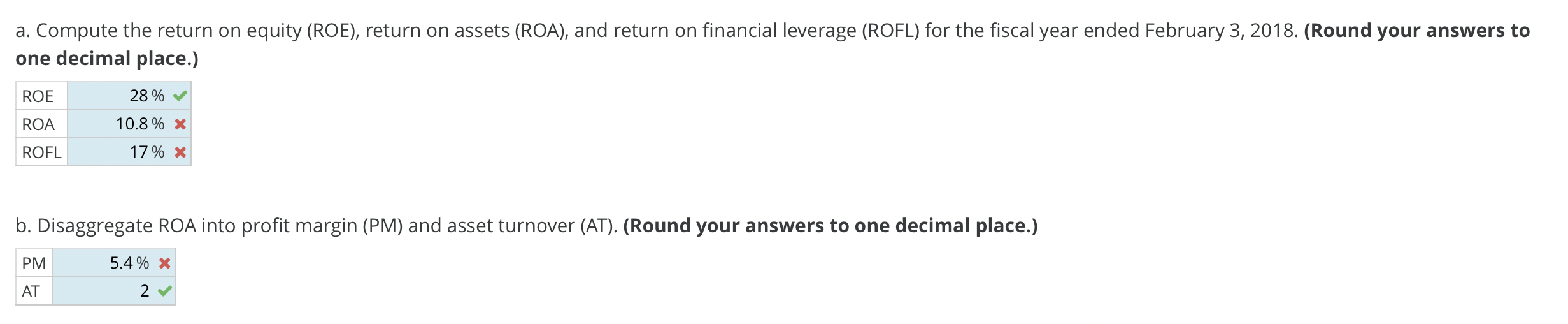

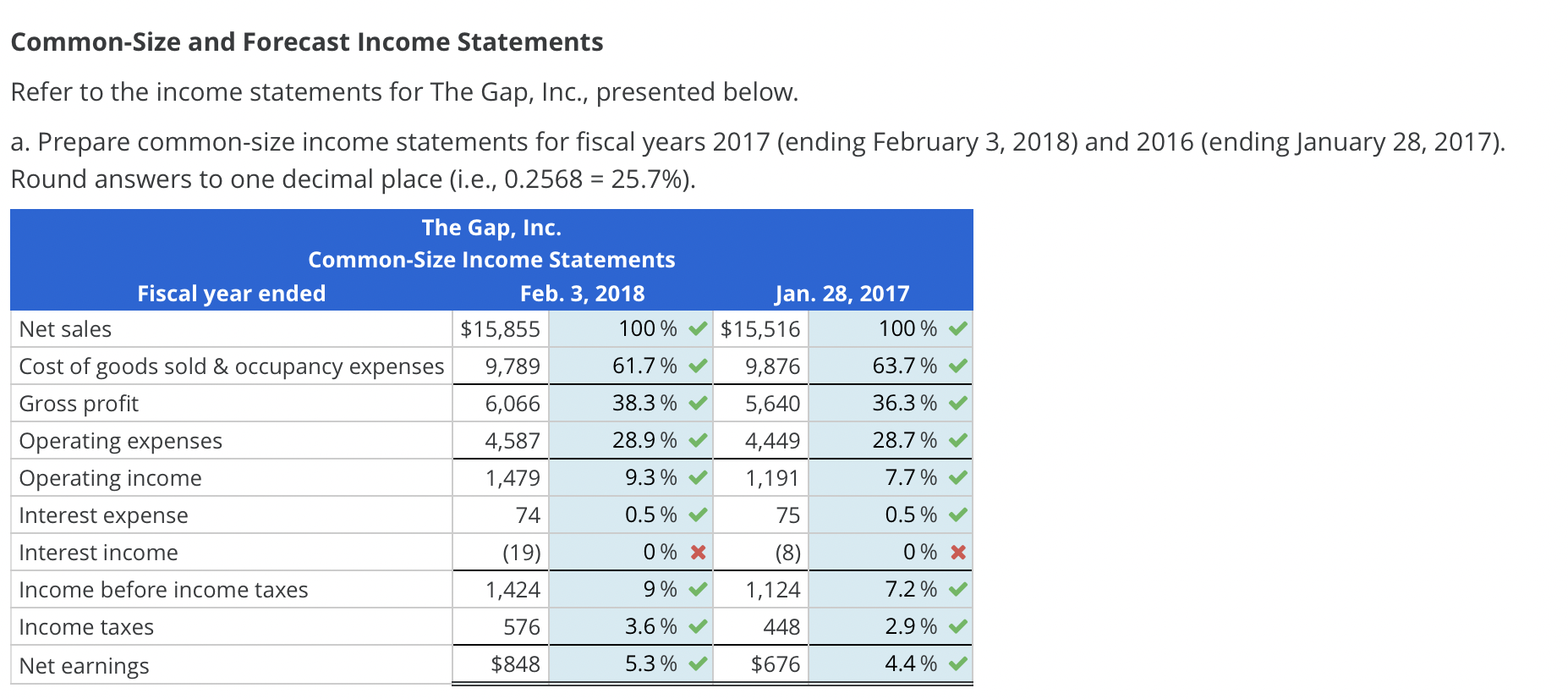

Compute, Disaggregate and Interpret ROE and ROA Income statements for The Gap, Inc., follow, along with selected balance sheet information ($ millions). The GAP, INC. Consolidated Statement of Earnings Fiscal year ended Feb. 3, 2018 Jan. 28, 2017 Net sales $15,855 $15,516 9,789 9,876 Cost of goods sold and occupancy expenses Gross profit 6,066 5,640 Operating expenses 4,587 4,449 Operating income 1,479 1,191 Interest expense 74 75 Interest income (19) (8) Income before income taxes 1,424 1,124 Income taxes 576 448 Net earnings $848 $676 Feb. 3, 2018 Jan. 28, 2017 Merchandise inventories $1,997 $1,830 Total assets 7,989 7,610 Total stockholders' equity 3,144 2,904 Assume a statutory tax rate of 35%. The GAP, INC. Selected Balance Sheet Data a. Compute the return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for the fiscal year ended February 3, 2018. (Round your answers to one decimal place.) ROE 28% ROA 10.8% * ROFL 17% X b. Disaggregate ROA into profit margin (PM) and asset turnover (AT). (Round your answers to one decimal place.) 5.4% * PM AT 2 Common-Size and Forecast Income Statements Refer to the income statements for The Gap, Inc., presented below. a. Prepare common-size income statements for fiscal years 2017 (ending February 3, 2018) and 2016 (ending January 28, 2017). Round answers to one decimal place (i.e., 0.2568 = 25.7%). The Gap, Inc. Common-Size Income Statements Feb. 3, 2018 Fiscal year ended Jan. 28, 2017 Net sales $15,855 100% Cost of goods sold & occupancy expenses 9,789 61.7% Gross profit 6,066 38.3% Operating expenses 4,587 28.9% Operating income 1,479 9.3% Interest expense 74 0.5% Interest income (19) 0% X Income before income taxes 1,424 9% Income taxes 576 3.6% Net earnings $848 5.3% $15,516 9,876 5,640 4,449 1,191 75 (8) 1,124 448 $676 100% 63.7% 36.3% 28.7% 7.7% 0.5% 0% X 7.2% 2.9% 4.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts