Question: 1. 2. PLEASE HELP ANSWER ASAP!! I WILL GIVE THUMBS UP ASAP. A company enters into a short futures contract to sell 60,000 pounds of

1.

2.

PLEASE HELP ANSWER ASAP!! I WILL GIVE THUMBS UP ASAP.

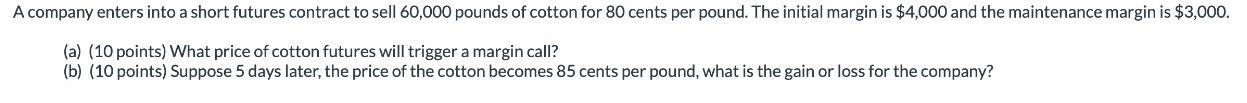

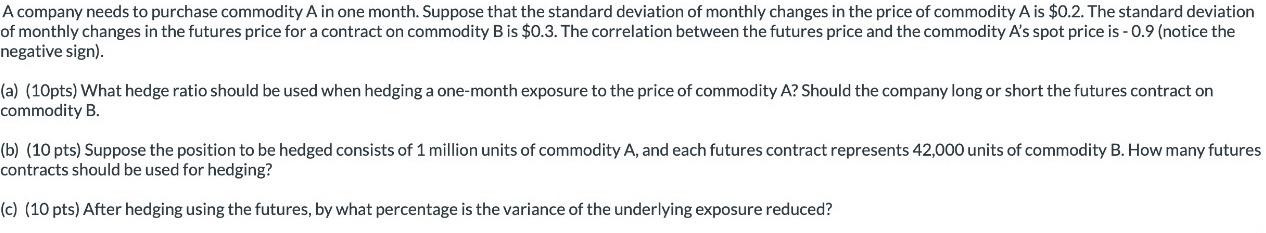

A company enters into a short futures contract to sell 60,000 pounds of cotton for 80 cents per pound. The initial margin is $4,000 and the maintenance margin is $3,000. (a) (10 points) What price of cotton futures will trigger a margin call? (b) (10 points) Suppose 5 days later, the price of the cotton becomes 85 cents per pound, what is the gain or loss for the company? A company needs to purchase commodity A in one month. Suppose that the standard deviation of monthly changes in the price of commodity A is $0.2. The standard deviation f monthly changes in the futures price for a contract on commodity B is $0.3. The correlation between the futures price and the commodity A's spot price is - 0.9 (notice the legative sign). a) (10pts) What hedge ratio should be used when hedging a one-month exposure to the price of commodity A? Should the company long or short the futures contract on ommodity B. b) (10 pts) Suppose the position to be hedged consists of 1 million units of commodity A, and each futures contract represents 42,000 units of commodity B. How many futures ontracts should be used for hedging? c) (10 pts) After hedging using the futures, by what percentage is the variance of the underlying exposure reduced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts