Question: ( 1 2 points ) On January 1 , 2 0 2 5 Lance Co . issued three - year bonds with a face value

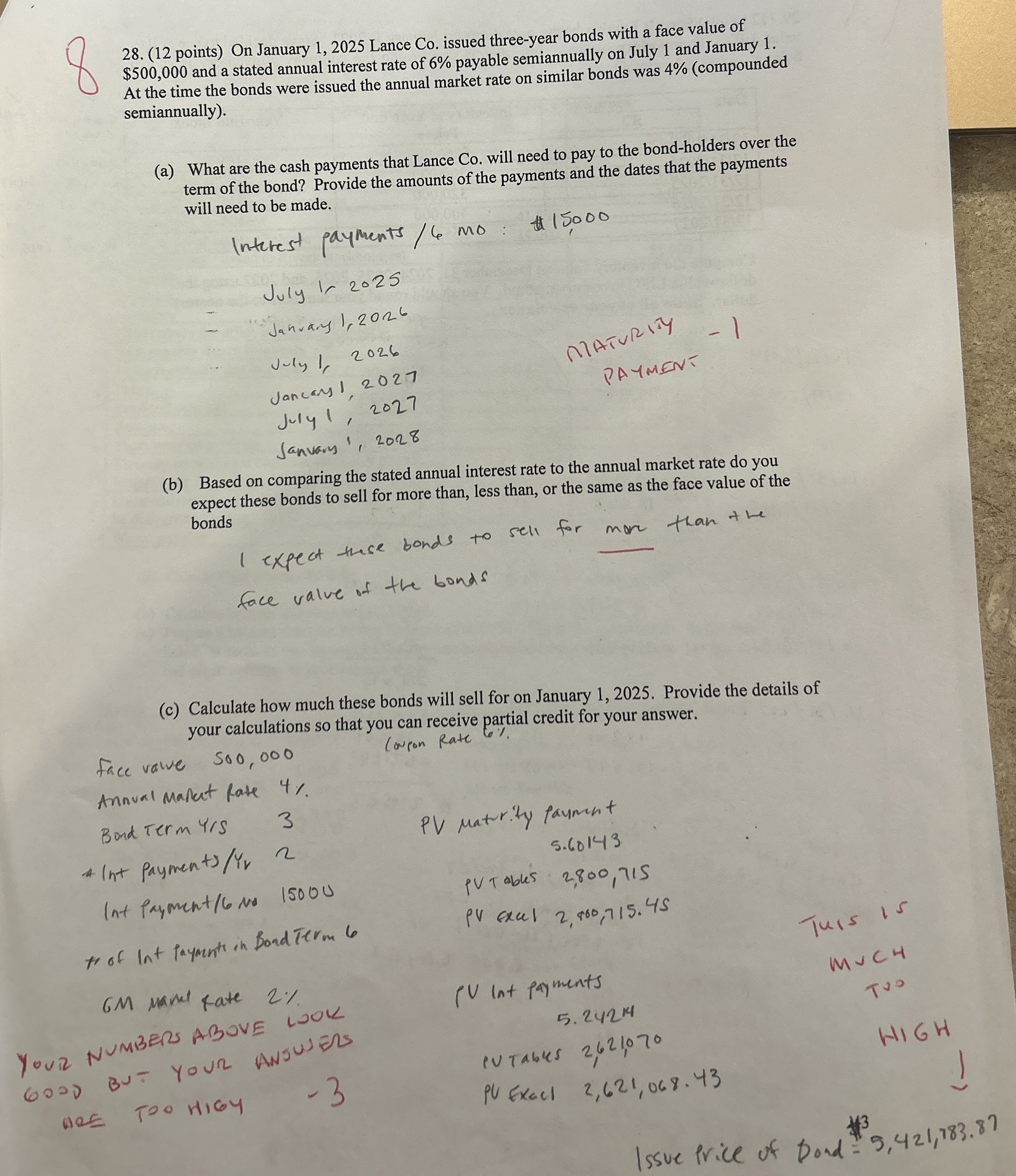

points On January Lance Co issued threeyear bonds with a face value of $ and a stated annual interest rate of payable semiannually on July and January At the time the bonds were issued the annual market rate on similar bonds was compounded semiannually

a What are the cash payments that Lance Co will need to pay to the bondholders over the term of the bond? Provide the amounts of the payments and the dates that the payments will need to be made.

Interest payments mo: #

July I,

Januang I,

July I,

Jancans!,

July I,

Janvary',

b Based on comparing the stated annual interest rate to the annual market rate do you expect these bonds to sell for more than, less than, or the same as the face value of the bonds

expect these bonds to sell for mor than the

face value of the bouds

c Calculate how much these bonds will sell for on January Provide the details of your calculations so that you can receive partial credit for your answer.

face value oupon Rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock