Question: 1 2 points References On December 3 1 , 2 0 2 3 , Dow Steel Corporation had 7 2 0 , 0 0 0

points

References

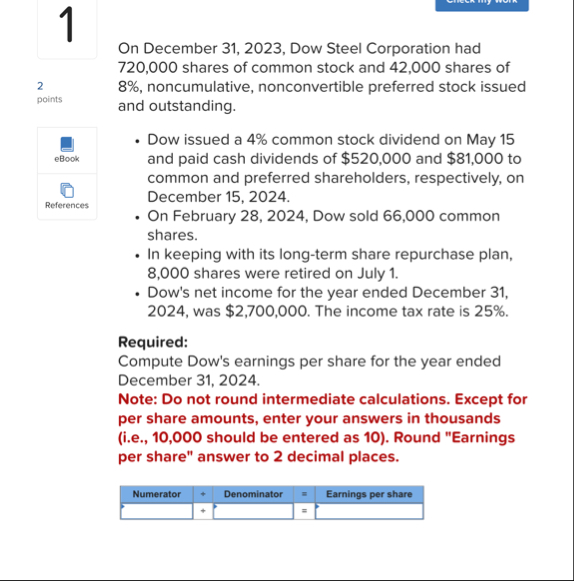

On December Dow Steel Corporation had shares of common stock and shares of noncumulative, nonconvertible preferred stock issued and outstanding.

Dow issued a common stock dividend on May and paid cash dividends of $ and $ to common and preferred shareholders, respectively, on December

On February Dow sold common shares.

In keeping with its longterm share repurchase plan, shares were retired on July

Dow's net income for the year ended December was $ The income tax rate is

Required:

Compute Dow's earnings per share for the year ended December

Note: Do not round intermediate calculations. Except for per share amounts, enter your answers in thousands ie should be entered as Round "Earnings per share" answer to decimal places.

tableNumeratorDenominator,Earnings per share

points

On December Dow Steel Corporation had shares of common stock and shares of noncumulative, nonconvertible preferred stock issued and outstanding.

Dow issued a common stock dividend on May and paid cash dividends of $ and $ to common and preferred shareholders, respectively, on December

On February Dow sold common shares.

In keeping with its longterm share repurchase plan, shares were retired on July

Dow's net income for the year ended December was $ The income tax rate is

Required:

Compute Dow's earnings per share for the year ended December

Note: Do not round intermediate calculations. Except for per share amounts, enter your answers in thousands ie should be entered as Round "Earnings per share" answer to decimal places.

tableNumeratorDenominator,Earnings per share

The Li Group had shares of common stock outstanding at January The following activities

points

References affected common shares during the year. There are no potential common shares outstanding.

February Purchased shares of treasury stock. ctober Sold the treasury shares purchased on February November Issued new shares. December Net income for is $

January Declared and issued a for stock split. December Net income for is $

Required:

Determine the EPS.

Determine the EPS.

At what amount will the EPS be presented in the comparative financial statements?

Note: Do not round intermediate calculations. Enter your answers in thousands ie should be entered as

tableNumerator Denominator,Earnings per Share

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock