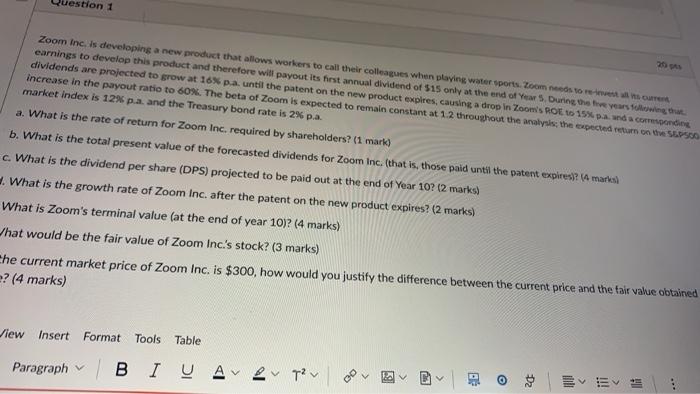

Question: 1: 2: Question 1 20 Zoom Inc. is developing a new product that allows workers to call their colleagues when playing water sports. Zoom needs

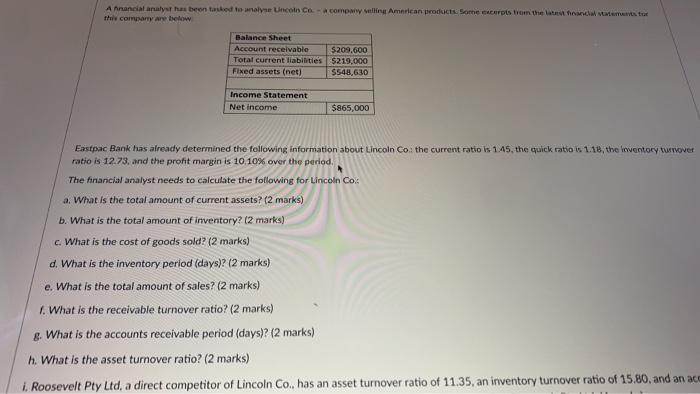

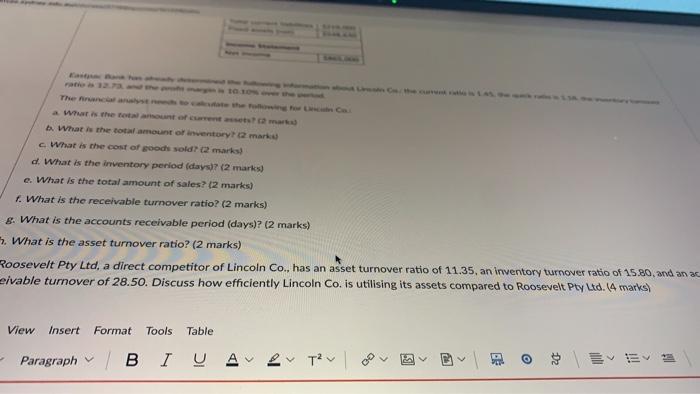

Question 1 20 Zoom Inc. is developing a new product that allows workers to call their colleagues when playing water sports. Zoom needs to remo earnings to develop this product and therefore will payout its first annual dividend of $15 only at the end of years. During the five years towing that dividends are projected to grow at 16% p.a. until the patent on the new product expires, causing a drop in Zoom's ROE to 15% and a corresponding increase in the payout ratio to 60%. The beta of Zoom is expected to remain constant at 12 throughout the analysis, the expected return on the SDS market index is 12% pa. and the Treasury bond rate is 2% p.a. a. What is the rate of return for Zoom Inc. required by shareholders? (1 mark) b. What is the total present value of the forecasted dividends for Zoom Inc. (that is, those paid until the patent expires!? (4 markes c. What is the dividend per share (DPS) projected to be paid out at the end of Year 10? (2 marks) What is the growth rate of Zoom Inc. after the patent on the new product expires? (2 marks) What is Zoom's terminal value (at the end of year 10)? (4 marks) What would be the fair value of Zoom Inc.'s stock? (3 marks) Che current market price of Zoom Inc. is $300, how would you justify the difference between the current price and the fair value obtained e? (4 marks) View Insert Format Tools Table Paragraph v BI U Aver qz v 12 B B VE Anancial analyst has been take to malyse Uncot Cocomowelling American productssome strom the latest and me the company are below Balance Sheet Account receivable $209.600 Total current liabilities $219.000 Fixed assets (net) $548,630 Income Statement Net income $865,000 Eastpac Bank has already determined the following information about Lincoln Co.: the current ratio is 1.45, the quick ratio is 1.18, the lewentory twover ratio is 12.73, and the profit margin is 10.10% over the period. The financial analyst needs to calculate the following for Lincoln Co. a What is the total amount of current assets? (2 marks) b. What is the total amount of inventory? (2 marks) c. What is the cost of goods sold? (2 marks) d. What is the inventory period (days)? (2 marks) e. What is the total amount of sales? (2 marks) 1. What is the receivable turnover ratio? (2 marks) g. What is the accounts receivable period (days)? (2 marks) h. What is the asset turnover ratio? (2 marks) 1. Roosevelt Pty Ltd, a direct competitor of Lincoln Co, has an asset turnover ratio of 11.35, an inventory turnover ratio of 15,80, and an ace The che What is the mount of me What is the total amount of entory marks What is the cost of goods sold? 2 marks) d. What is the inventory period (days? (2 marks) e. What is the total amount of sales? (2 marks) 1. What is the receivable turnover ratio? (2 marks) 8. What is the accounts receivable period (days)? (2 marks) 7. What is the asset turnover ratio? (2 marks) Roosevelt Pty Ltd, a direct competitor of Lincoln Co., has an asset turnover ratio of 11.35, an inventory turnover ratio of 15.80, and an ac eivable turnover of 28.50. Discuss how efficiently Lincoln Co. is utilising its assets compared to Roosevelt Pty Ltd. (4 marks) View Insert Format Tools Table Paragraph | B I U ev T~ D2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts