Question: 1. 2. Question 63 (3 points) ) Listen You agree to make 24 deposits of $500 at the beginning of each month into a bank

1.

2.

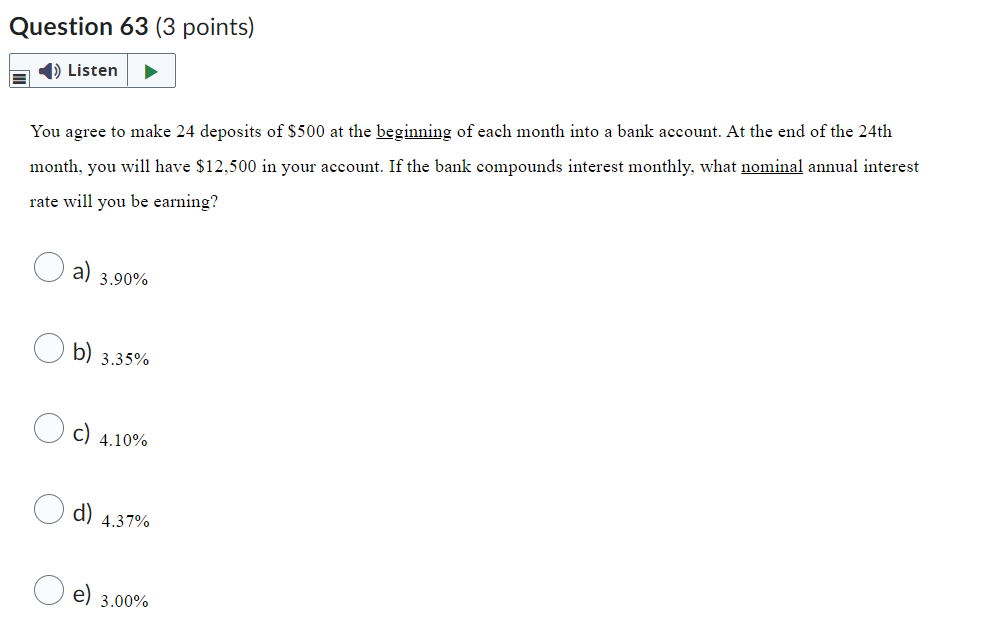

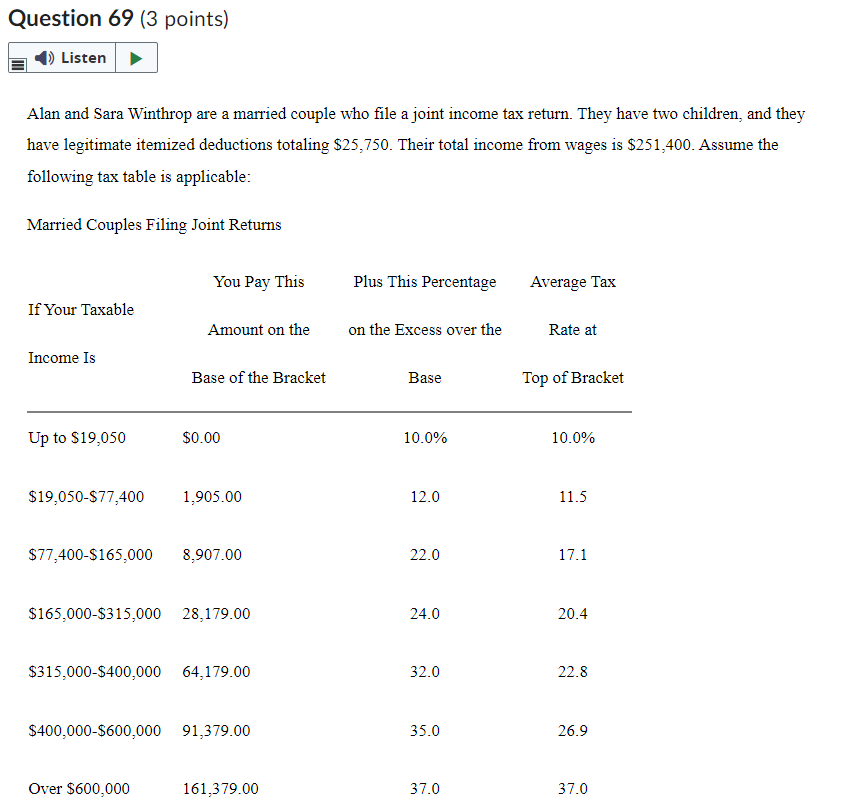

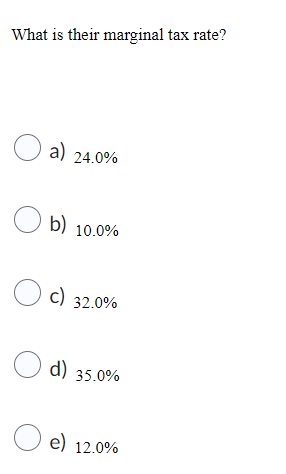

Question 63 (3 points) ) Listen You agree to make 24 deposits of $500 at the beginning of each month into a bank account. At the end of the 24th month, you will have $12,500 in your account. If the bank compounds interest monthly, what nominal annual interest rate will you be earning? a) 3.90% b) 3.35% C) 4.10% d) 4.37% e) 3.00% Question 69 (3 points) 1) Listen Alan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, and they have legitimate itemized deductions totaling $25,750. Their total income from wages is $251,400. Assume the following tax table is applicable: Married Couples Filing Joint Returns You Pay This Plus This Percentage Average Tax If Your Taxable Amount on the on the Excess over the Rate at Income Is Base of the Bracket Base Top of Bracket Up to $19,050 $0.00 10.0% 10.0% $19,050-$77,400 1,905.00 12.0 11.5 $77,400-$165,000 8,907.00 22.0 17.1 $165,000-$315,000 28,179.00 24.0 20.4 $315,000-$400,000 64,179.00 32.0 22.8 $400,000-$600,000 91,379.00 35.0 26.9 Over $600,000 161,379.00 37.0 37.0 What is their marginal tax rate? O a) O b) a) 24.0% b) 10.0% O c) c) 32.0% O d) 35.0% O e) 12.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts