Question: 1. 2. (Related to Checkpoint 11.1) (Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project

1.

2.

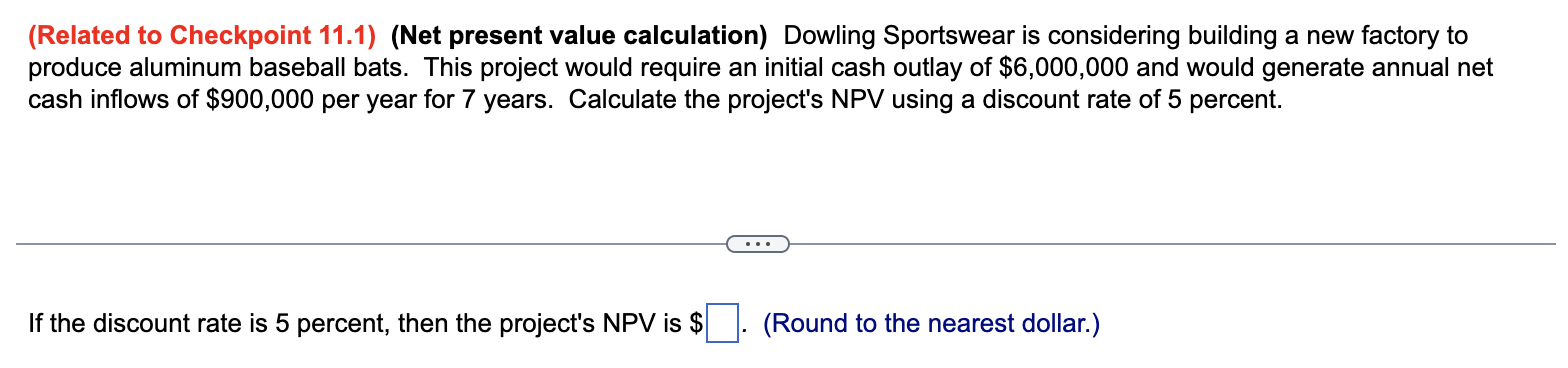

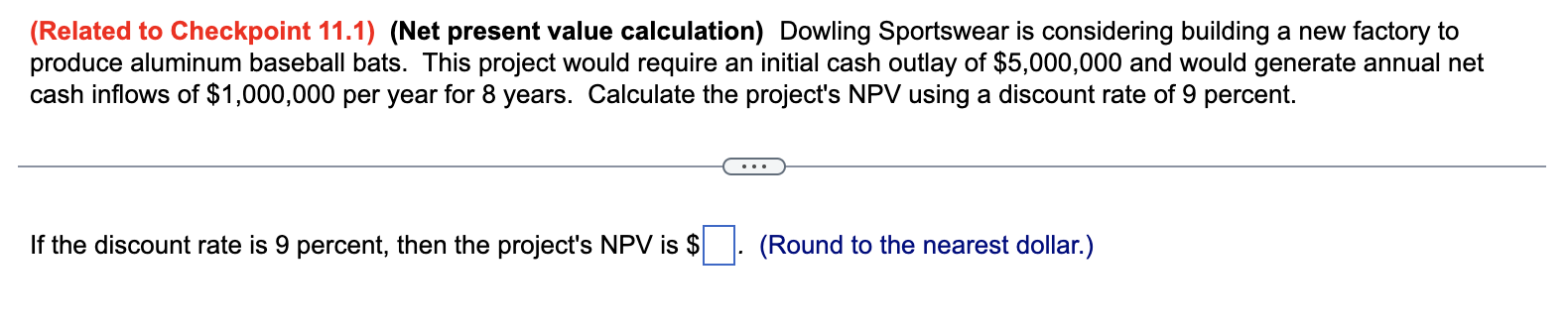

(Related to Checkpoint 11.1) (Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $6,000,000 and would generate annual net cash inflows of $900,000 per year for 7 years. Calculate the project's NPV using a discount rate of 5 percent. If the discount rate is 5 percent, then the project's NPV is $ (Round to the nearest dollar.) (Related to Checkpoint 11.1) (Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $5,000,000 and would generate annual net cash inflows of $1,000,000 per year for 8 years. Calculate the project's NPV using a discount rate of 9 percent. If the discount rate is 9 percent, then the project's NPV is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts