Question: 1. 2. RTS Company is evaluating two mutually exclusive projects on the basis of payback. RTS is risk averse and will not accept any project

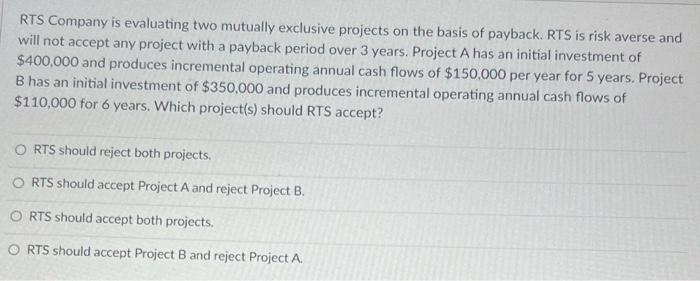

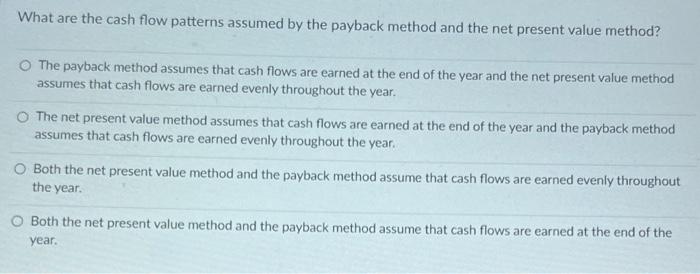

RTS Company is evaluating two mutually exclusive projects on the basis of payback. RTS is risk averse and will not accept any project with a payback period over 3 years. Project A has an initial investment of $400,000 and produces incremental operating annual cash flows of $150,000 per year for 5 years. Project B has an initial investment of $350,000 and produces incremental operating annual cash flows of $110,000 for 6 years. Which project(s) should RTS accept? RTS should reject both projects, RTS should accept Project A and reject Project B. RTS should accept both projects. RTS should accept Project B and reject Project A. What are the cash flow patterns assumed by the payback method and the net present value method? The payback method assumes that cash flows are earned at the end of the year and the net present value method assumes that cash flows are earned evenly throughout the year. The net present value method assumes that cash flows are earned at the end of the year and the payback method assumes that cash flows are earned evenly throughout the year. Both the net present value method and the payback method assume that cash flows are earned evenly throughout the year. Both the net present value method and the payback method assume that cash flows are earned at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts