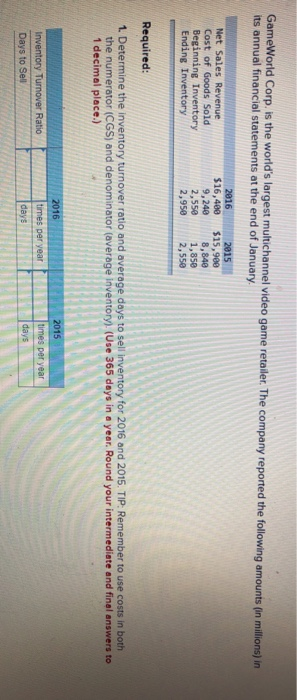

Question: 1) 2) There are two questions in # 2 Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using

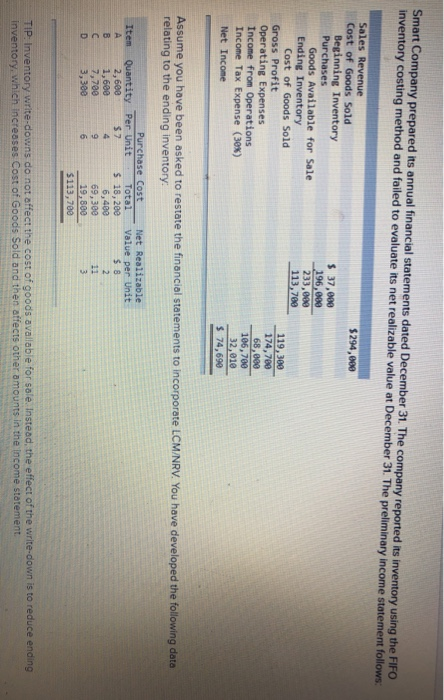

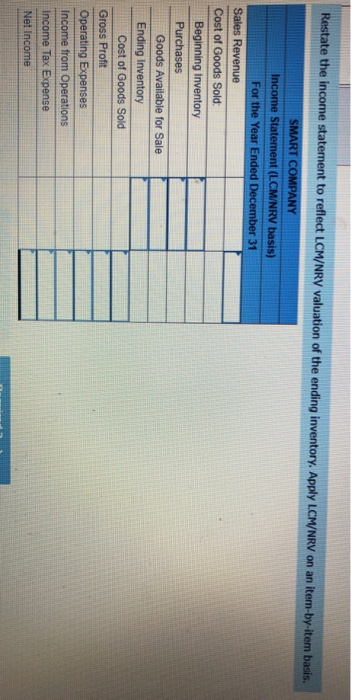

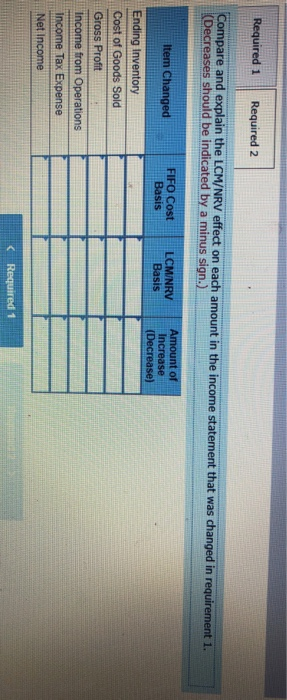

Smart Company prepared its annual financial statements dated December 31. The company reported its inventory using the FIFO inventory costing method and failed to evaluate its net realizable value at December 31. The preliminary income statement follows: Sales Revenue Cost of Goods Sold $294,000 Beginning Inventory Purchases 37,000 196,000 233,000 113,700 Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income 119,300 174,780 68,000 106,700 32,010 s 74,690 Assume you have been asked to restate the financial statements to incorporate LCM/NRV. You have developed the following data relating to the ending inventory Purchase Cost Net Realizable Item Quantity Per Unit Total Value per Unit s 18, 200 6,400 69,300 19,800 s7 s 8 2,600 8 1,600 7,700 D 3,300 $113,700 TIP: Inventory write-downs do not affect the cost of goods avallable for sale. Instead, the effect of the write-down is to reduce ending inventory, which increases Cost of Goods Sold and then affects other amounts in the Income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts