Question: 1. 2. Using the data below for the Ace Guitar Company: A Region B Region Sales $548,000 Cost of goods sold 208,200 131,500 $822,000 312,400

1.

2.

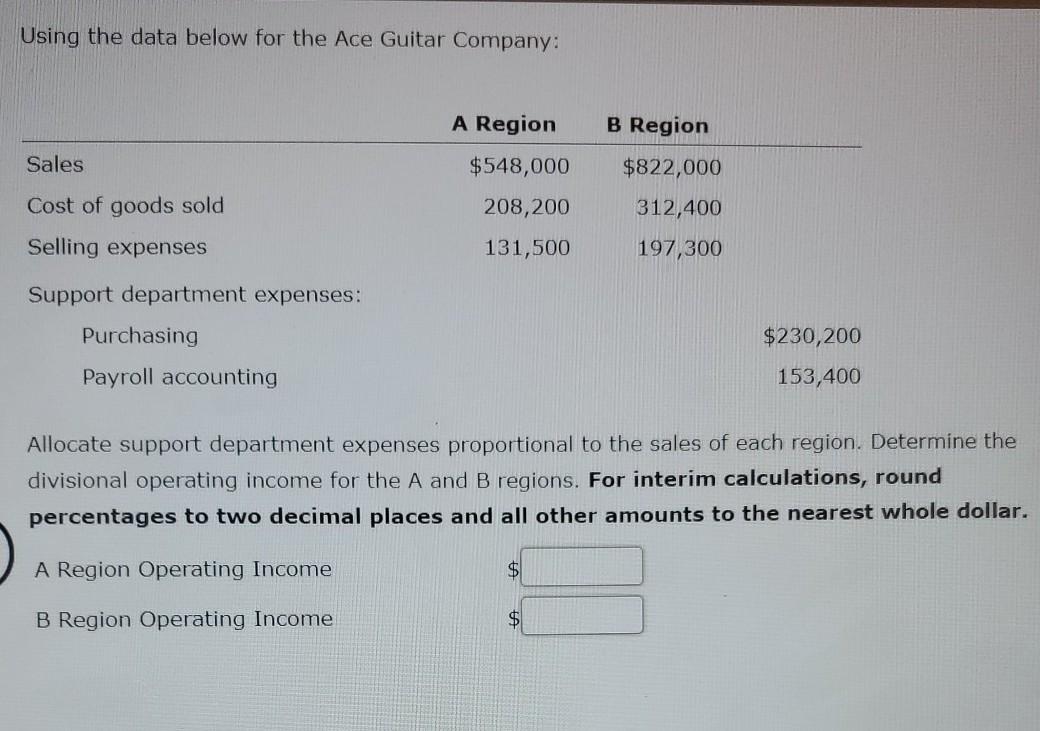

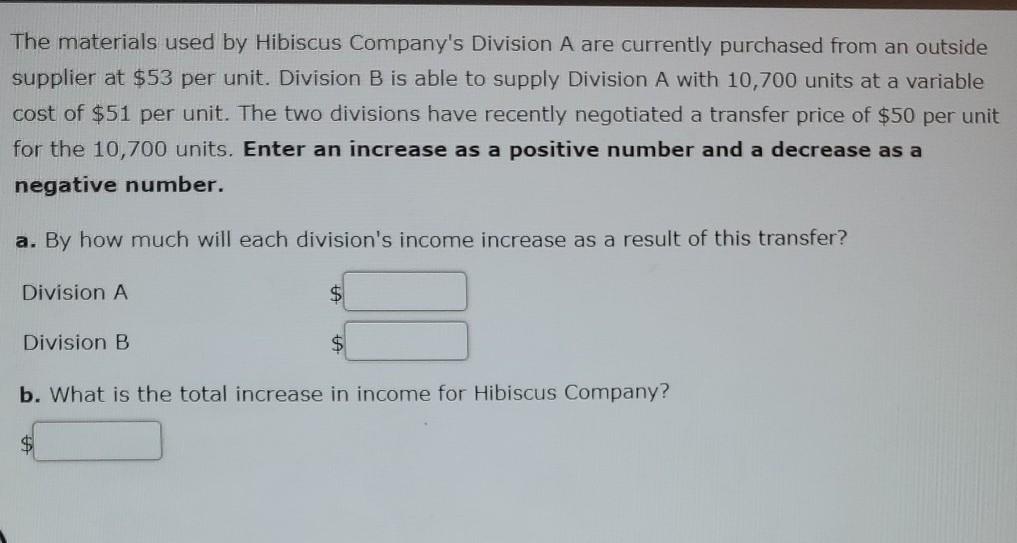

Using the data below for the Ace Guitar Company: A Region B Region Sales $548,000 Cost of goods sold 208,200 131,500 $822,000 312,400 197,300 Selling expenses Support department expenses: Purchasing Payroll accounting $230,200 153,400 Allocate support department expenses proportional to the sales of each region. Determine the divisional operating income for the A and B regions. For interim calculations, round percentages to two decimal places and all other amounts to the nearest whole dollar. A Region Operating Income $ B Region Operating Income $ The materials used by Hibiscus Company's Division A are currently purchased from an outside supplier at $53 per unit. Division B is able to supply Division A with 10,700 units at a variable cost of $51 per unit. The two divisions have recently negotiated a transfer price of $50 per unit for the 10,700 units. Enter an increase as a positive number and a decrease as a negative number. a. By how much will each division's income increase as a result of this transfer? Division A $ Division B b. What is the total increase in income for Hibiscus Company? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts