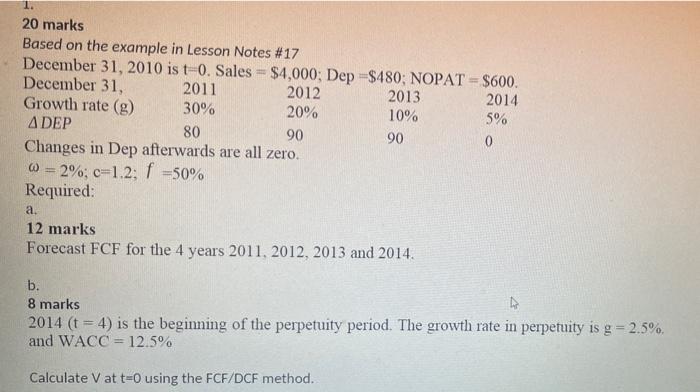

Question: 1. 20 marks Based on the example in Lesson Notes #17 December 31, 2010 is t-0. Sales = $4,000: Dep $480; NOPAT = $600. December

1. 20 marks Based on the example in Lesson Notes #17 December 31, 2010 is t-0. Sales = $4,000: Dep $480; NOPAT = $600. December 31, 2011 2012 2013 2014 Growth rate (g) 30% 20% 10% 5% ADEP 80 90 90 0 Changes in Dep afterwards are all zero. W = 2%; c=1.2; f =50% Required: a. 12 marks Forecast FCF for the 4 years 2011, 2012, 2013 and 2014 b. 8 marks 2014 (t = 4) is the beginning of the perpetuity period. The growth rate in perpetuity is g = 2.5%, and WACC = 12.5% Calculate V at t=using the FCF/DCF method. 1. 20 marks Based on the example in Lesson Notes #17 December 31, 2010 is t-0. Sales = $4,000: Dep $480; NOPAT = $600. December 31, 2011 2012 2013 2014 Growth rate (g) 30% 20% 10% 5% ADEP 80 90 90 0 Changes in Dep afterwards are all zero. W = 2%; c=1.2; f =50% Required: a. 12 marks Forecast FCF for the 4 years 2011, 2012, 2013 and 2014 b. 8 marks 2014 (t = 4) is the beginning of the perpetuity period. The growth rate in perpetuity is g = 2.5%, and WACC = 12.5% Calculate V at t=using the FCF/DCF method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts