Question: 1. [20 marks] Start each question on a new page Consider a non-dividend paying stock whose initial stock price is 62 and which has a

![1. [20 marks] Start each question on a new page Consider](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66edc87d9ab18_38966edc87d3d711.jpg)

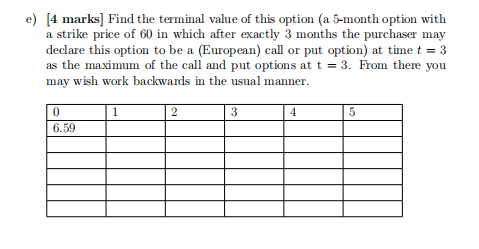

1. [20 marks] Start each question on a new page Consider a non-dividend paying stock whose initial stock price is 62 and which has a log-volatility of o = 0.20. The interest rate r = 10%, compounded monthly. Consider a 5-month option with a strike price of 60 in which after exactly 3 months the purchaser may declare this option to be a (European) call or put option. Assume u = 1.05943 and d= * = 0.94390 a) [3 marks] Compute the values of the binomial lattice for 5 1 month period. 1 2 3 4 5 0 62 b) [3 marks) Compute the appropriate risk-free rate. c) [3 marks] Find the risk-neutral probability of going up? d) [6 marks] Find the values of call option and put option along this lattice: 1 2 3 4 5 0 5.85 call option 1 2 3 4 5 0 1.40 put option e) [4 marks) Find the terminal value of this option (a 5-month option with a strike price of 60 in which after exactly 3 months the purchaser may declare this option to be a (European) call or put option) at time t = 3 as the maximum of the call and put options at t = 3. From there you may wish work backwards in the usual manner. 1 2 3 4 5 0 6.59 1. [20 marks] Start each question on a new page Consider a non-dividend paying stock whose initial stock price is 62 and which has a log-volatility of o = 0.20. The interest rate r = 10%, compounded monthly. Consider a 5-month option with a strike price of 60 in which after exactly 3 months the purchaser may declare this option to be a (European) call or put option. Assume u = 1.05943 and d= * = 0.94390 a) [3 marks] Compute the values of the binomial lattice for 5 1 month period. 1 2 3 4 5 0 62 b) [3 marks) Compute the appropriate risk-free rate. c) [3 marks] Find the risk-neutral probability of going up? d) [6 marks] Find the values of call option and put option along this lattice: 1 2 3 4 5 0 5.85 call option 1 2 3 4 5 0 1.40 put option e) [4 marks) Find the terminal value of this option (a 5-month option with a strike price of 60 in which after exactly 3 months the purchaser may declare this option to be a (European) call or put option) at time t = 3 as the maximum of the call and put options at t = 3. From there you may wish work backwards in the usual manner. 1 2 3 4 5 0 6.59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts