Question: 1. (25 points) Calder Inc. is considering a four-year project to manufacture military drones. This project requires an initial investment of $10 million that will

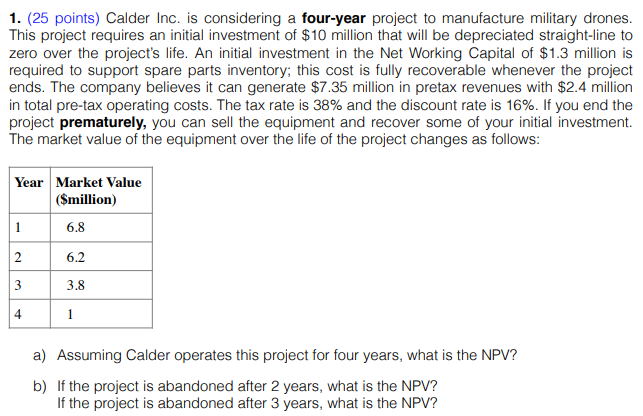

1. (25 points) Calder Inc. is considering a four-year project to manufacture military drones. This project requires an initial investment of $10 million that will be depreciated straight-line to zero over the project's life. An initial investment in the Net Working Capital of $1.3 million is required to support spare parts inventory; this cost is fully recoverable whenever the project ends. The company believes it can generate $7.35 million in pretax revenues with $2.4 million in total pre-tax operating costs. The tax rate is 38% and the discount rate is 16%. If you end the project prematurely, you can sell the equipment and recover some of your initial investment. The market value of the equipment over the life of the project changes as follows: Year Market Value ($million) 6.8 2 6.2 3.8 a) Assuming Calder operates this project for four years, what is the NPV? b) If the project is abandoned after 2 years, what is the NPV? If the project is abandoned after 3 years, what is the NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts