Question: 1. (25 points) Consider two firms, 1 and 2, producing an identical good simul- taneously. This good has market demand given by the demand

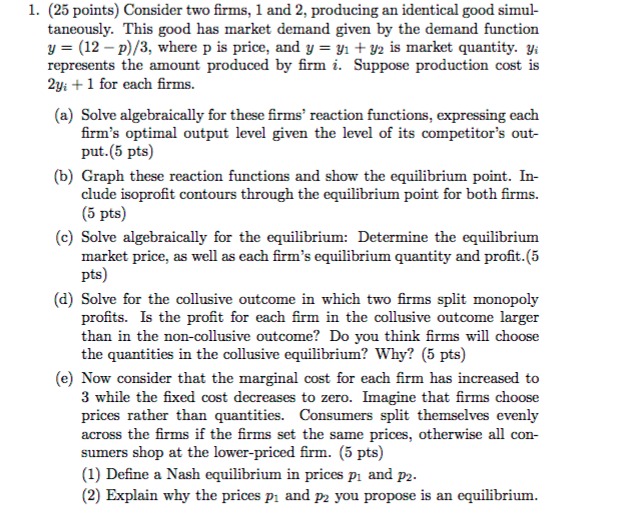

1. (25 points) Consider two firms, 1 and 2, producing an identical good simul- taneously. This good has market demand given by the demand function y = (12-p)/3, where p is price, and y = y + y2 is market quantity. y represents the amount produced by firm i. Suppose production cost is 2y + 1 for each firms. (a) Solve algebraically for these firms' reaction functions, expressing each firm's optimal output level given the level of its competitor's out- put. (5 pts) (b) Graph these reaction functions and show the equilibrium point. In- clude isoprofit contours through the equilibrium point for both firms. (5 pts) (c) Solve algebraically for the equilibrium: Determine the equilibrium market price, as well as each firm's equilibrium quantity and profit. (5 pts) (d) Solve for the collusive outcome in which two firms split monopoly profits. Is the profit for each firm in the collusive outcome larger than in the non-collusive outcome? Do you think firms will choose the quantities in the collusive equilibrium? Why? (5 pts) (e) Now consider that the marginal cost for each firm has increased to 3 while the fixed cost decreases to zero. Imagine that firms choose prices rather than quantities. Consumers split themselves evenly across the firms if the firms set the same prices, otherwise all con- sumers shop at the lower-priced firm. (5 pts) (1) Define a Nash equilibrium in prices p and p2. (2) Explain why the prices p and p2 you propose is an equilibrium.

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Answer a To solve for the reaction functions we first need to find the profitmaximizing output level for each firm given the output level of its compe... View full answer

Get step-by-step solutions from verified subject matter experts