Question: 1) 26 points Pat is a sales representative for a publishing company. He entertains customers as part of his job. During the current year he

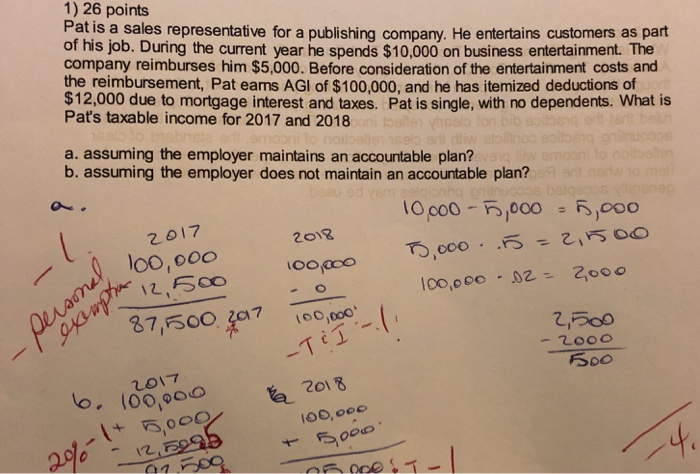

1) 26 points Pat is a sales representative for a publishing company. He entertains customers as part of his job. During the current year he spends $10,000 on business entertainment. The company reimburses him $5,000. Before consideration of the entertainment costs and the reimbursement, Pat eams AGl of $100,000, and he has itemized deductions of $12,000 due to mortgage interest and taxes. Pat is single, with no dependents. What is Pat's taxable income for 2017 and 2018 a. assuming the employer maintains an accountable plan? b. assuming the employer does not maintain an accountable plan? 2017 loo,ooo 2018 37,500. ,o 2,5oo Soo 201 100, ooo

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock