Question: ( { } ^ { 1 } ) Click the icon to view the MACRS depreciation schedules. ( { } ^ {

Click the icon to view the MACRS depreciation schedules.

Click the icon to view the interest factors for discrete compounding when i per year.

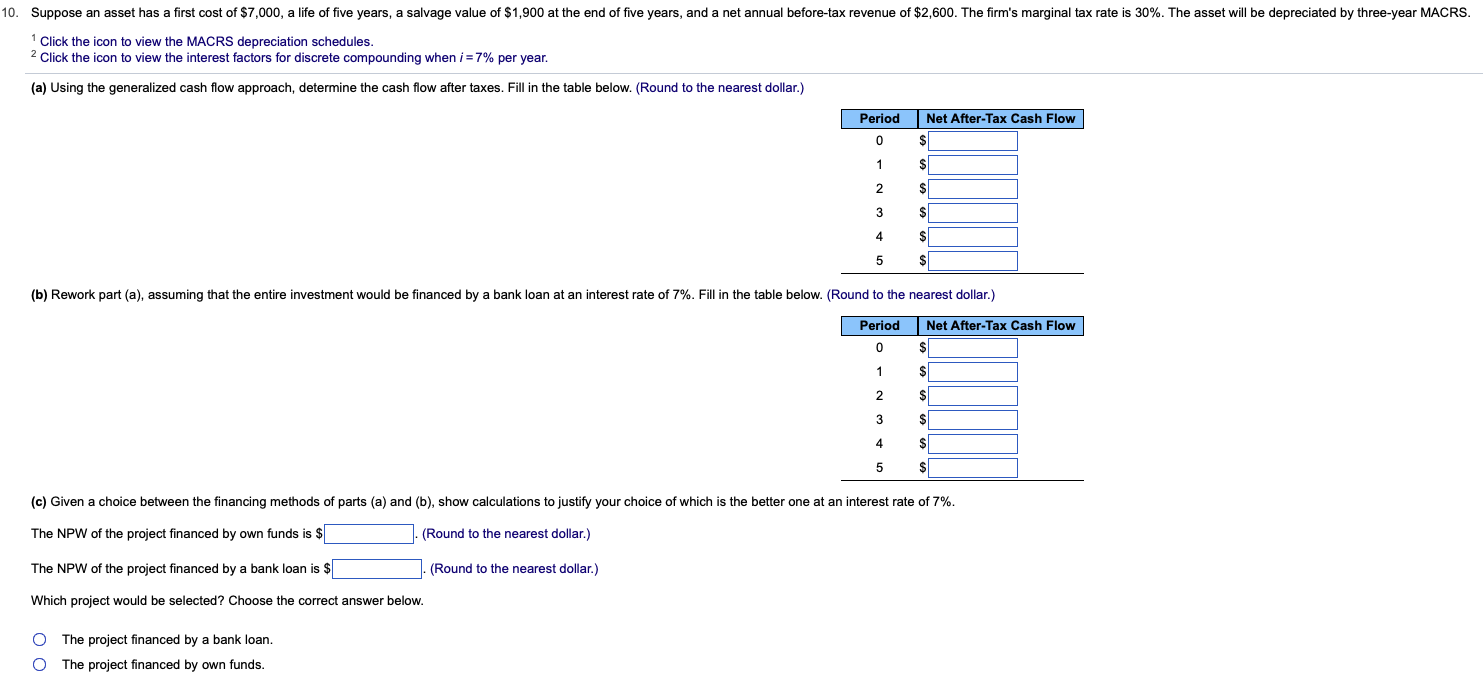

a Using the generalized cash flow approach, determine the cash flow after taxes. Fill in the table below. Round to the nearest dollar.

b Rework part a assuming that the entire investment would be financed by a bank loan at an interest rate of Fill in the table below. Round to the nearest dollar.

c Given a choice between the financing methods of parts a and b show calculations to justify your choice of which is the better one at an interest rate of

The NPW of the project financed by own funds is $ Round to the nearest dollar.

The NPW of the project financed by a bank loan is $ Round to the nearest dollar.

Which project would be selected? Choose the correct answer below.

The project financed by a bank loan.

The project financed by own funds. : More Info

Year to switch from declining balance to straight line

: More Info

begintabularccccccc

hline & multicolumnlSingle Payment & multicolumncEqual Payment Series

hline N & begintabularl

Compound

Amount

Factor

FP i N

endtabular & begintabularl

Present

Worth

Factor

PF i N

endtabular & begintabularl

Compound

Amount

Factor

FA i N

endtabular & begintabularl

Sinking

Fund

Factor

AF i N

endtabular & begintabularl

Present

Worth

Factor

P A i N

endtabular & begintabularl

Capital

Recovery

Factor

AP i N

endtabular

hline & & & & & &

hline & & & & & &

hline & & & & & &

hline & & & & & &

hline & & & & & &

hline & & & & & &

hline & & & & & &

hline & & & & & &

hline & & & & & &

hline & & & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock