Question: 1 3 , 0 - aar = x 8 5 ? 2 5 , 1 1 : 2 3 P M aining detail: Curriculum Question

aar

:

aining detail: Curriculum

Question of

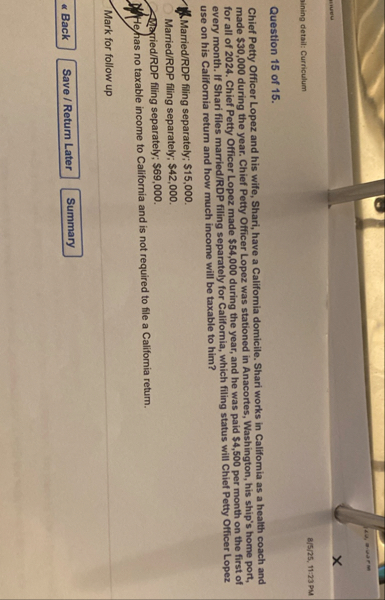

Chief Petty Officer Lopez and his wife, Shari, have a California domicile. Shari works in Califomia as a health coach and made $ during the year. Chief Petty Officer Lopez was stationed in Anacortes, Washington, his ship's home port, for all of Chief Petty Officer Lopez made $ during the year, and he was paid $ per month on the first of every month. If Shari files marriedRDP filing separately for California, which filing status with Chiel Petty Officer Lopez use on his California return and how much income will be taxable to him?

MarriedRDP filing separately; $

MarriedRDP filing separately; $

TPriedRDP filing separately; $

He has no taxable income to California and is not required to file a California return.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock