Question: 1 3 . 4 Reserve Prices ( Harder ) : Consider a seller who must sell a single private value good. There are two potential

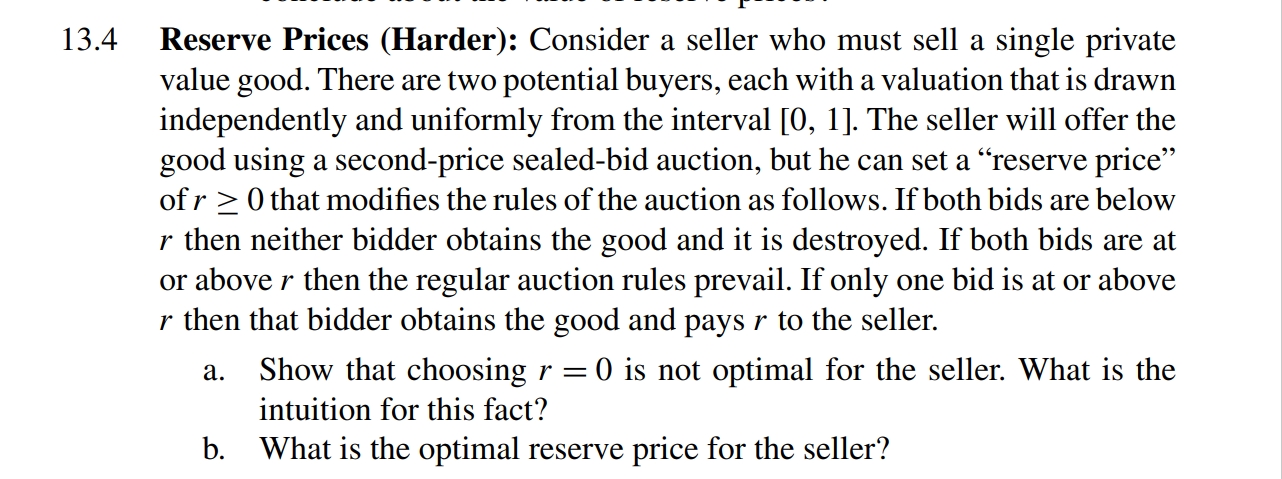

Reserve Prices Harder: Consider a seller who must sell a single private value good. There are two potential buyers, each with a valuation that is drawn independently and uniformly from the interval The seller will offer the good using a secondprice sealedbid auction, but he can set a "reserve price" of r geq that modifies the rules of the auction as follows. If both bids are below r then neither bidder obtains the good and it is destroyed. If both bids are at or above r then the regular auction rules prevail. If only one bid is at or above r then that bidder obtains the good and pays r to the seller.

a Show that choosing r is not optimal for the seller. What is the intuition for this fact?

b What is the optimal reserve price for the seller?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock