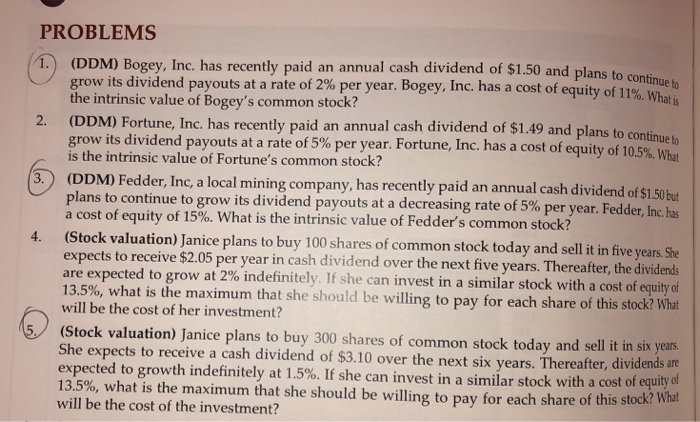

Question: #1, 3, 5 PROBLEMS 1.) (DDM) Bogey, Inc. has recently paid an annual cash dividend of $1.50 and plans to co grow its dividend payouts

PROBLEMS 1.) (DDM) Bogey, Inc. has recently paid an annual cash dividend of $1.50 and plans to co grow its dividend payouts at a rate of 2% per year. Bogey, Inc. has a cost of equity of 11%, WW the intrinsic value of Bogey's common stock? (DDM) Fortune, Inc. has recently paid an annual cash dividend of $1.49 and plans to continue grow its dividend payouts at a rate of 5% per year. Fortune, Inc. has a cost of equity of 10.5%. What is the intrinsic value of Fortune's common stock? 3. (DDM) Fedder, Inc, a local mining company, has recently paid an annual cash dividend of $1.50 but plans to continue to grow its dividend payouts at a decreasing rate of 5% per year. Fedder, Inc. has a cost of equity of 15%. What is the intrinsic value of Fedder's common stock? (Stock valuation) Janice plans to buy 100 shares of common stock today and sell it in five years. She expects to receive $2.05 per year in cash dividend over the next five years. Thereafter, the dividends are expected to grow at 2% indefinitely. If she can invest in a similar stock with a cost of equity of 13.5%, what is the maximum that she should be willing to pay for each share of this stock? What will be the cost of her investment? (Stock valuation) Janice plans to buy 300 shares of common stock today and sell it in six years. She expects to receive a cash dividend of $3.10 over the next six years. Thereafter, dividends are expected to growth indefinitely at 1.5%. If she can invest in a similar stock with a cost of equity of 13.5%, what is the maximum that she should be willing to pay for each share of this stock? W will be the cost of the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts