Question: 1 : 3 6 Back Accounting _ II - _ Assignment _ 9 - _ Capital _ A . . . 2 of 3 Assignment

:

Back AccountingIIAssignmentCapitalA

of

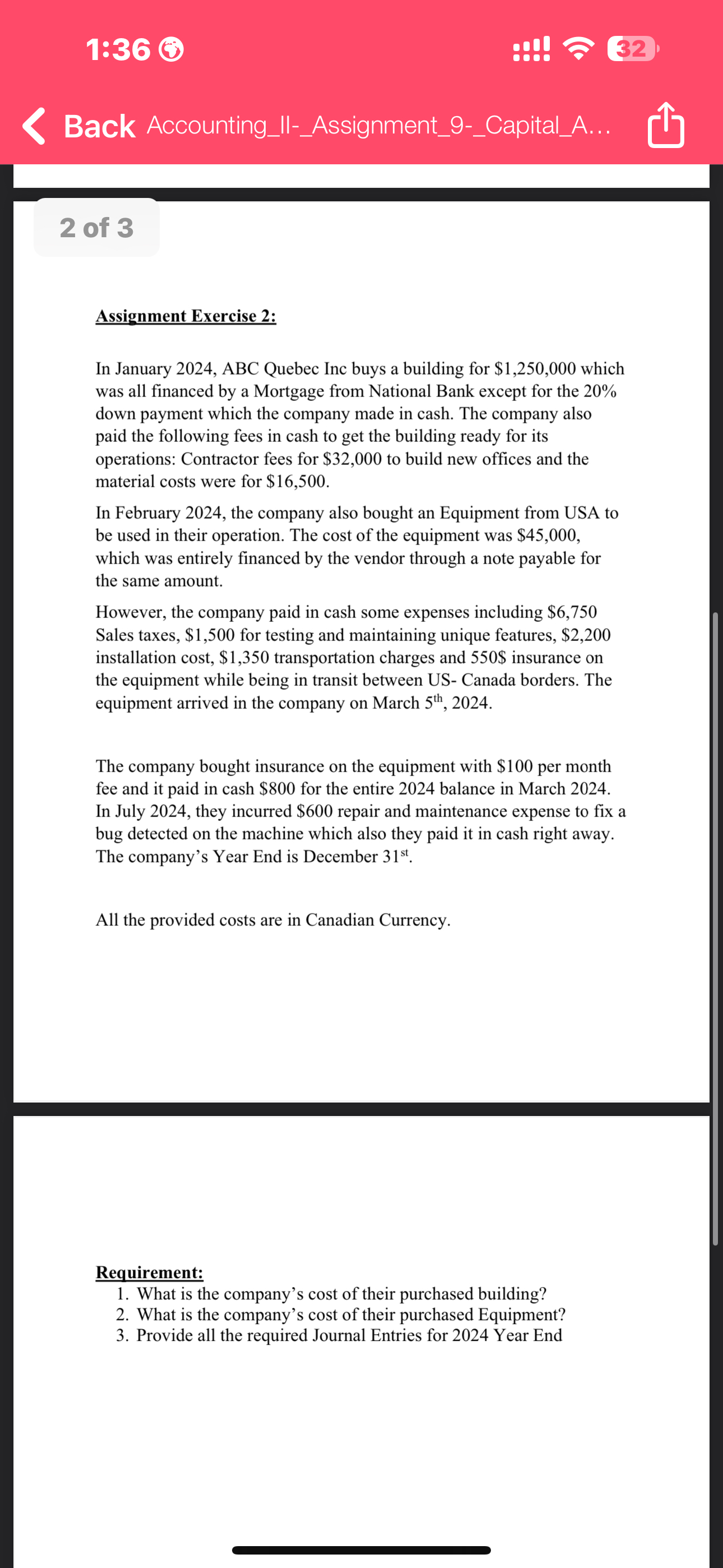

Assignment Exercise :

In January ABC Quebec Inc buys a building for $ which was all financed by a Mortgage from National Bank except for the down payment which the company made in cash. The company also paid the following fees in cash to get the building ready for its operations: Contractor fees for $ to build new offices and the material costs were for $

In February the company also bought an Equipment from USA to be used in their operation. The cost of the equipment was $ which was entirely financed by the vendor through a note payable for the same amount.

However, the company paid in cash some expenses including $

Sales taxes, $ for testing and maintaining unique features, $ installation cost, $ transportation charges and $ insurance on the equipment while being in transit between US Canada borders. The equipment arrived in the company on March

The company bought insurance on the equipment with $ per month fee and it paid in cash $ for the entire balance in March In July they incurred $ repair and maintenance expense to fix a bug detected on the machine which also they paid it in cash right away. The company's Year End is December

All the provided costs are in Canadian Currency.

Requirement:

What is the company's cost of their purchased building?

What is the company's cost of their purchased Equipment?

Provide all the required Journal Entries for Year End

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock