Question: 1 3 Multiple Choice 2 - 2 1 ( LO 2 - 3 ) A taxpayer can claim a dependent if the person is a

Multiple Choice LO

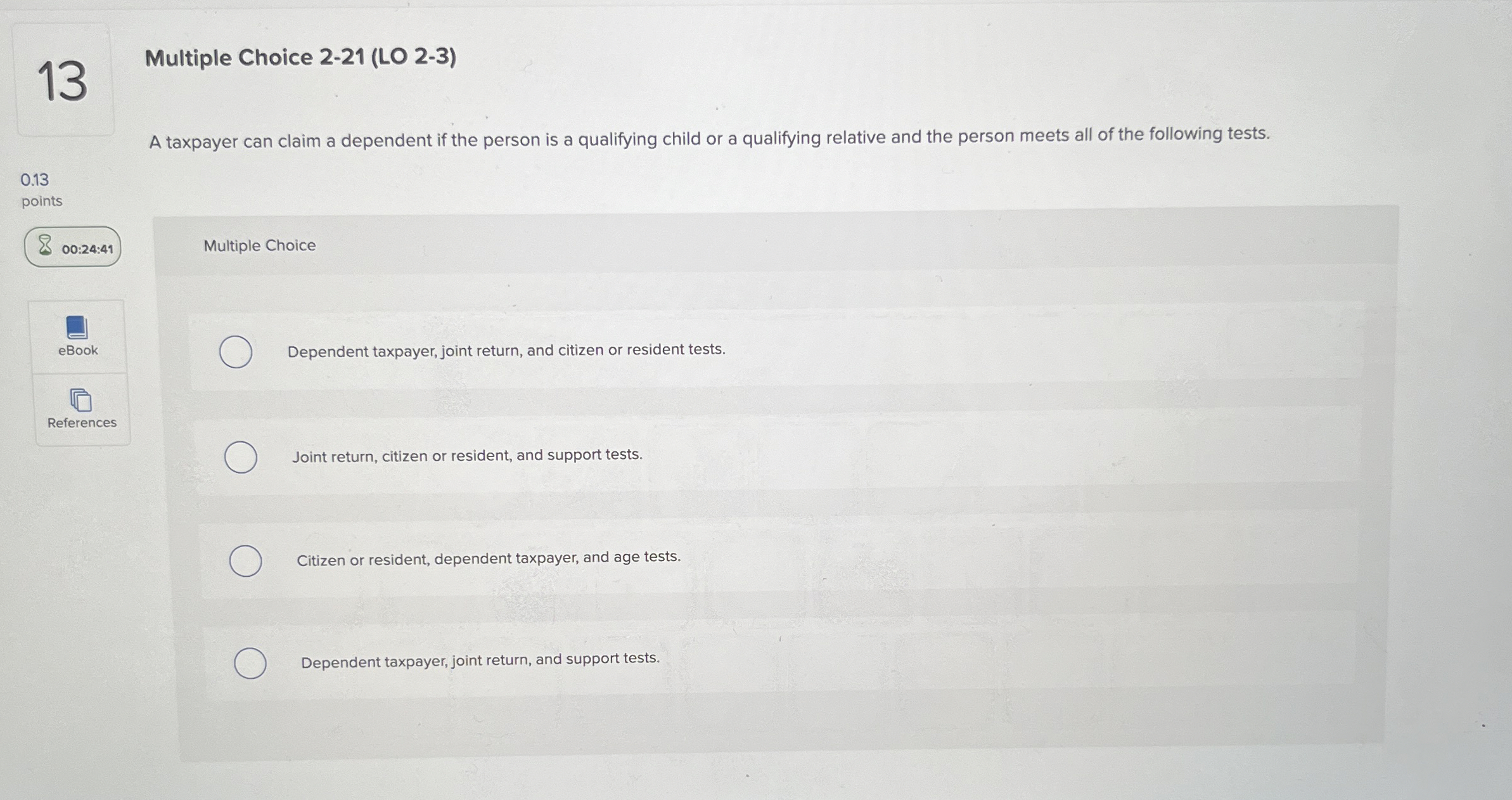

A taxpayer can claim a dependent if the person is a qualifying child or a qualifying relative and the person meets all of the following tests.

points

::

eBook

References

Multiple Choice

Dependent taxpayer, joint return, and citizen or resident tests.

Joint return, citizen or resident, and support tests.

Citizen or resident, dependent taxpayer, and age tests.

Dependent taxpayer, joint return, and support tests

Multiple Choice LO

A taxpayer can claim a dependent if the person is a qualifying child or a qualifying relative and the person meets all of the following tests.

points

::

eBook

References

Multiple Choice

Dependent taxpayer, joint return, and citizen or resident tests.

Joint return, citizen or resident, and support tests.

Citizen or resident, dependent taxpayer, and age tests.

Dependent taxpayer, joint return, and support tests.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock