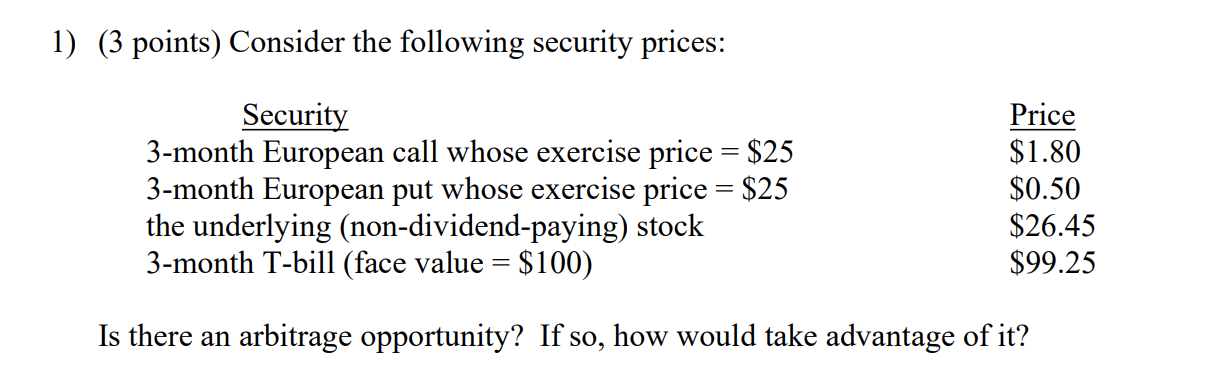

Question: 1) (3 points) Consider the following security prices: Security 3-month European call whose exercise price = $25 3-month European put whose exercise price =

1) (3 points) Consider the following security prices: Security 3-month European call whose exercise price = $25 3-month European put whose exercise price = $25 the underlying (non-dividend-paying) stock 3-month T-bill (face value = $100) Is there an arbitrage opportunity? If so, how would take advantage of it? Price $1.80 $0.50 $26.45 $99.25

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

No there is not an arbitrage opportunity present in this scenario An arbitrage opportunity arises wh... View full answer

Get step-by-step solutions from verified subject matter experts