Question: 1. (3 points) Make a case for why Petrozuata should not get an investment grade credit rating. 2. (2 points) Investigate what actually happened with

1. (3 points) Make a case for why Petrozuata should not get an investment grade credit rating.

1. (3 points) Make a case for why Petrozuata should not get an investment grade credit rating.

2. (2 points) Investigate what actually happened with Petrozuata. Briefly answer the following questions: (i) What credit rating was assigned to the project? (ii) How did the project fare in its first five years (up to 2005)? (iii) How did political risk play out in the end? (iv) Do you think ConocoPhillips would have gone ahead with Petrozuata with the benefit of hindsight (i.e., if it knew what would happen)? Why or why not

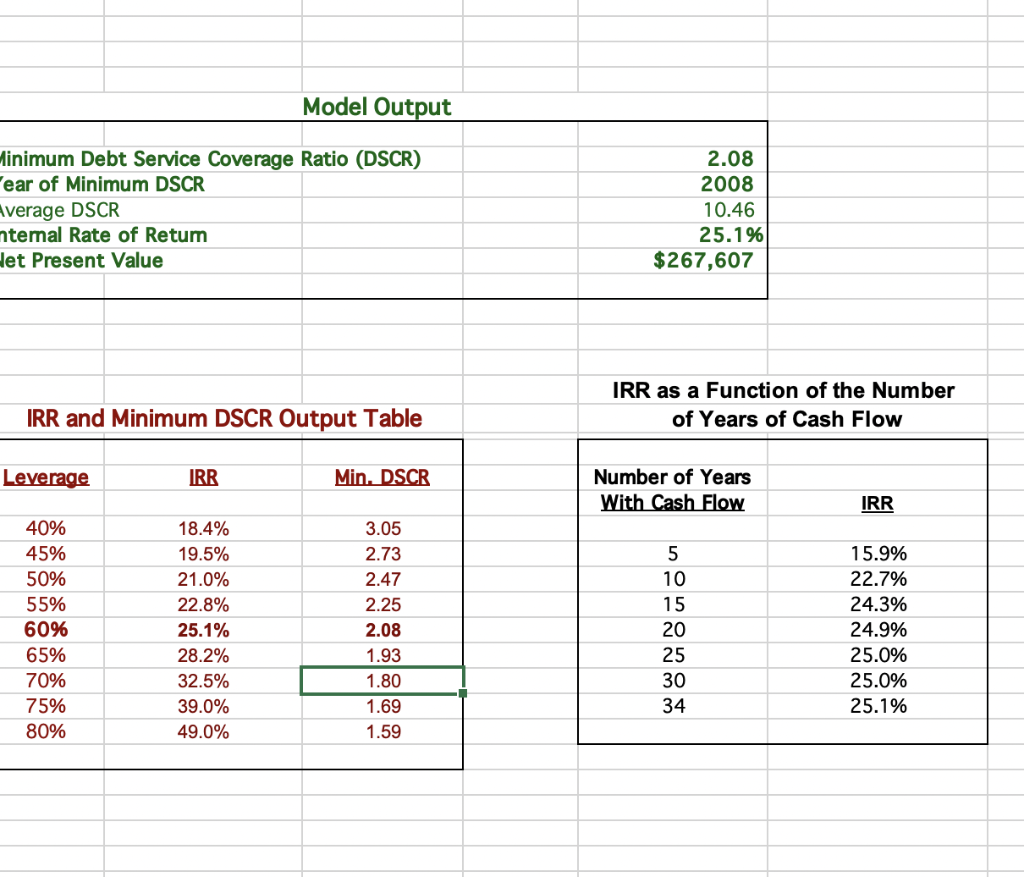

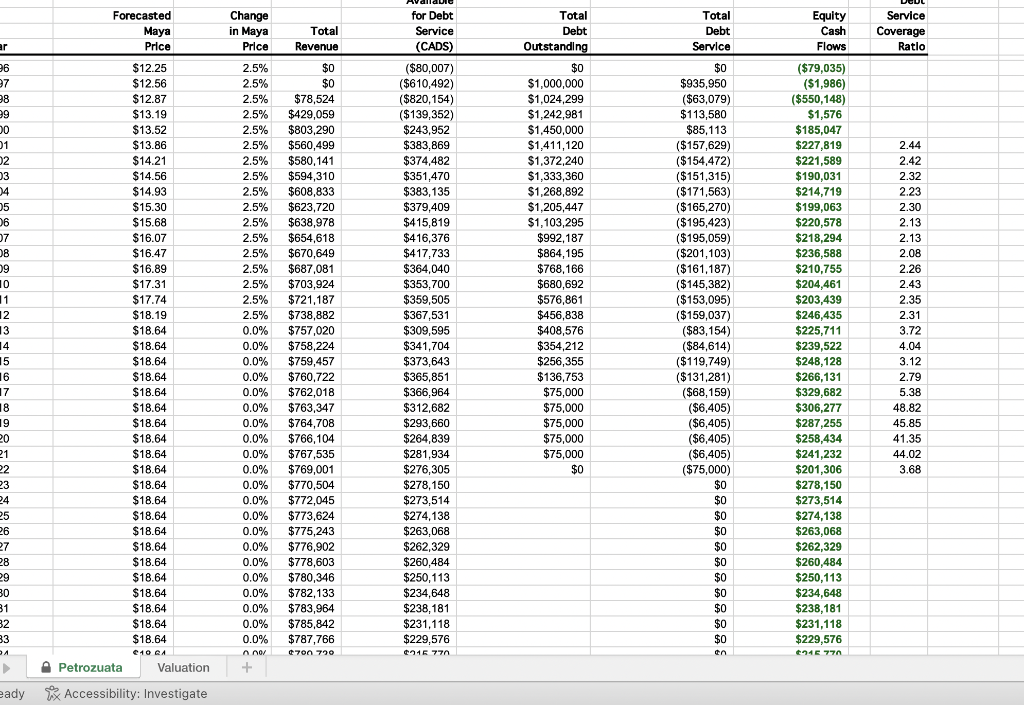

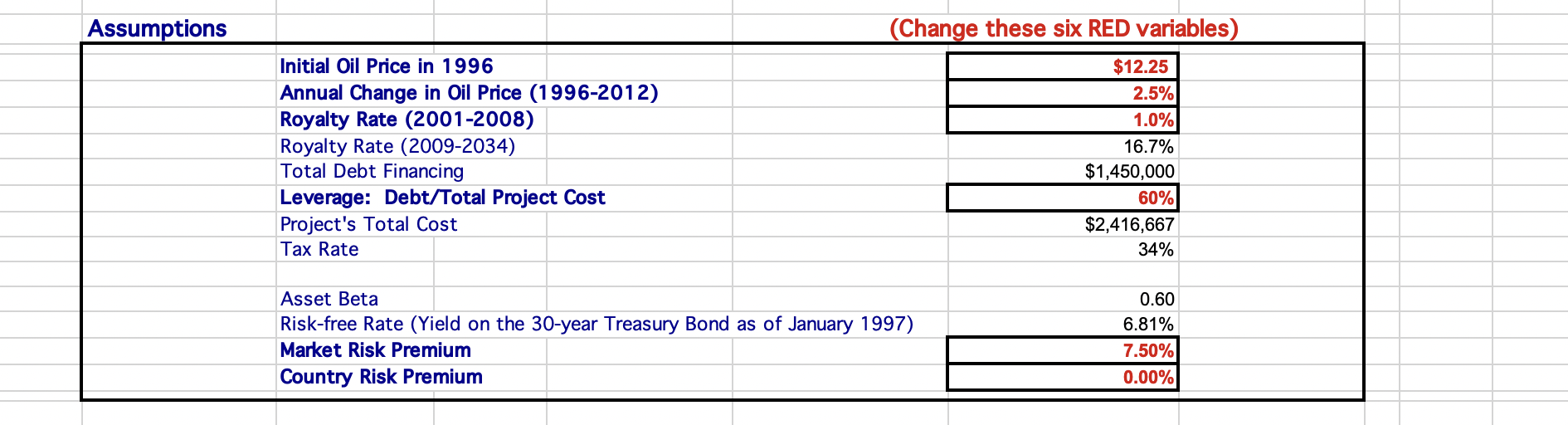

Model Output \begin{tabular}{l|l|r|} \hline linimum Debt Service Coverage Ratio (DSCR) & & 2.08 \\ \hline ear of Minimum DSCR & 2008 \\ \hline Iverage DSCR & & 10.46 \\ \hline temal Rate of Retum & & 25.1% \\ \hline let Present Value & & $267,607 \\ \hline \end{tabular} IRR as a Function of the Number \begin{tabular}{|l|c|c|} \hline \multicolumn{2}{|c|}{ IRR and Minimum DSCR Output Table } \\ \hline & & \\ \hline Leverage & IRR & Min. DSCR \\ \hline & & \\ \hline 40% & 18.4% & 3.05 \\ \hline 45% & 19.5% & 2.73 \\ \hline 50% & 21.0% & 2.47 \\ \hline 55% & 22.8% & 2.25 \\ \hline 60% & 25.1% & 2.08 \\ \hline 65% & 28.2% & 1.93 \\ \hline 70% & 32.5% & 1.80 \\ \hline 75% & 39.0% & 1.69 \\ \hline 80% & 49.0% & 1.59 \\ \hline & & \\ \hline \end{tabular} of Years of Cash Flow \begin{tabular}{|c|c|} \hline Number of Years & \\ \hline With Cash Flow & IRR \\ \hline 5 & 15.9% \\ \hline 10 & 22.7% \\ \hline 15 & 24.3% \\ \hline 20 & 24.9% \\ \hline 25 & 25.0% \\ \hline 30 & 25.0% \\ 34 & 25.1% \\ \hline \end{tabular} Assumptions (Change these six RED variables) \begin{tabular}{|l|r|r|} \hline Initial Oil Price in 1996 & $12.25 \\ \hline Annual Change in Oil Price (1996-2012) & 2.5% \\ \hline Royalty Rate (2001-2008) & 1.0% \\ \hline Royalty Rate (2009-2034) & 16.7% \\ \hline Total Debt Financing & $1,450,000 \\ \hline Leverage: Debt/Total Project Cost & 60% \\ \hline Project's Total Cost & $2,416,667 \\ \hline Tax Rate & & 34% \\ \hline Asset Beta & & 0.60 \\ \hline Risk-free Rate (Yield on the 30-year Treasury Bond as of January 1997) & 6.81% \\ \hline Market Risk Premium & & 7.50% \\ \hline Country Risk Premium & 0.00% \\ \hline \end{tabular} Model Output \begin{tabular}{l|l|r|} \hline linimum Debt Service Coverage Ratio (DSCR) & & 2.08 \\ \hline ear of Minimum DSCR & 2008 \\ \hline Iverage DSCR & & 10.46 \\ \hline temal Rate of Retum & & 25.1% \\ \hline let Present Value & & $267,607 \\ \hline \end{tabular} IRR as a Function of the Number \begin{tabular}{|l|c|c|} \hline \multicolumn{2}{|c|}{ IRR and Minimum DSCR Output Table } \\ \hline & & \\ \hline Leverage & IRR & Min. DSCR \\ \hline & & \\ \hline 40% & 18.4% & 3.05 \\ \hline 45% & 19.5% & 2.73 \\ \hline 50% & 21.0% & 2.47 \\ \hline 55% & 22.8% & 2.25 \\ \hline 60% & 25.1% & 2.08 \\ \hline 65% & 28.2% & 1.93 \\ \hline 70% & 32.5% & 1.80 \\ \hline 75% & 39.0% & 1.69 \\ \hline 80% & 49.0% & 1.59 \\ \hline & & \\ \hline \end{tabular} of Years of Cash Flow \begin{tabular}{|c|c|} \hline Number of Years & \\ \hline With Cash Flow & IRR \\ \hline 5 & 15.9% \\ \hline 10 & 22.7% \\ \hline 15 & 24.3% \\ \hline 20 & 24.9% \\ \hline 25 & 25.0% \\ \hline 30 & 25.0% \\ 34 & 25.1% \\ \hline \end{tabular} Assumptions (Change these six RED variables) \begin{tabular}{|l|r|r|} \hline Initial Oil Price in 1996 & $12.25 \\ \hline Annual Change in Oil Price (1996-2012) & 2.5% \\ \hline Royalty Rate (2001-2008) & 1.0% \\ \hline Royalty Rate (2009-2034) & 16.7% \\ \hline Total Debt Financing & $1,450,000 \\ \hline Leverage: Debt/Total Project Cost & 60% \\ \hline Project's Total Cost & $2,416,667 \\ \hline Tax Rate & & 34% \\ \hline Asset Beta & & 0.60 \\ \hline Risk-free Rate (Yield on the 30-year Treasury Bond as of January 1997) & 6.81% \\ \hline Market Risk Premium & & 7.50% \\ \hline Country Risk Premium & 0.00% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts