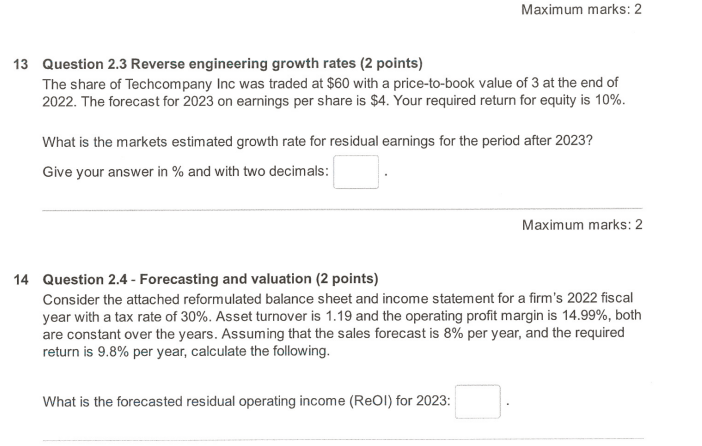

Question: 1 3 Question 2 . 3 Reverse engineering growth rates ( 2 points ) The share of Techcompany Inc was traded at $ 6 0

Question Reverse engineering growth rates points

The share of Techcompany Inc was traded at $ with a pricetobook value of at the end of

The forecast for on earnings per share is $ Your required return for equity is

What is the markets estimated growth rate for residual earnings for the period after

Give your answer in and with two decimals:

Maximum marks:

Question Forecasting and valuation points

Consider the attached reformulated balance sheet and income statement for a firm's fiscal

year with a tax rate of Asset turnover is and the operating profit margin is both

are constant over the years. Assuming that the sales forecast is per year, and the required

return is per year, calculate the following.

What is the forecasted residual operating income ReOI for :

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock