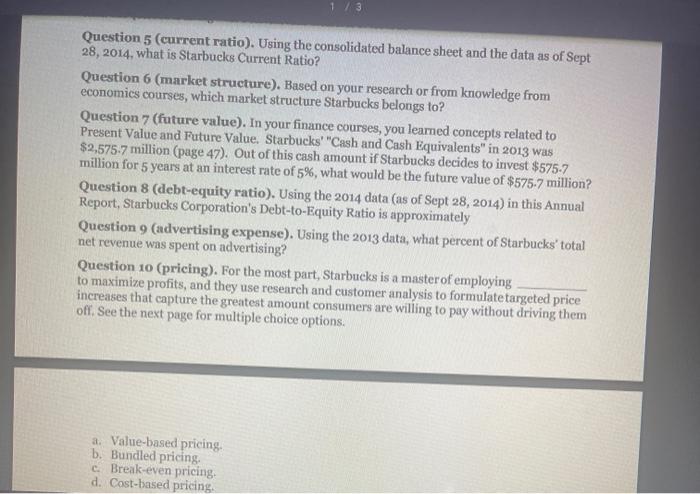

Question: 1 / 3 Question 5 (current ratio). Using the consolidated balance sheet and the data as of Sept 28, 2014, what is Starbucks Current Ratio?

1 / 3 Question 5 (current ratio). Using the consolidated balance sheet and the data as of Sept 28, 2014, what is Starbucks Current Ratio? Question 6 (market structure). Based on your research or from knowledge from economics courses, which market structure Starbucks belongs to? Question 7 (future value). In your finance courses, you learned concepts related to Present Value and Future Value Starbucks' "Cash and Cash Equivalents" in 2013 was $2,575.7 million (page 47). Out of this cash amount if Starbucks decides to invest $575-7 million for 5 years at an interest rate of 5%, what would be the future value of $575.7 million? Question 8 (debt-equity ratio). Using the 2014 data (as of Sept 28, 2014) in this Annual Report, Starbucks Corporation's Debt-to-Equity Ratio is approximately Question 9 (advertising expense). Using the 2013 data, what percent of Starbucks' total net revenue was spent on advertising? Question 10 (pricing). For the most part, Starbucks is a master of employing to maximize profits, and they use research and customer analysis to formulate targeted price increases that capture the greatest amount consumers are willing to pay without driving them off. See the next page for multiple choice options. a. Value-based pricing. b. Bundled pricing c Break-even pricing, d. Cost-based pricing. 1 / 3 Question 5 (current ratio). Using the consolidated balance sheet and the data as of Sept 28, 2014, what is Starbucks Current Ratio? Question 6 (market structure). Based on your research or from knowledge from economics courses, which market structure Starbucks belongs to? Question 7 (future value). In your finance courses, you learned concepts related to Present Value and Future Value Starbucks' "Cash and Cash Equivalents" in 2013 was $2,575.7 million (page 47). Out of this cash amount if Starbucks decides to invest $575-7 million for 5 years at an interest rate of 5%, what would be the future value of $575.7 million? Question 8 (debt-equity ratio). Using the 2014 data (as of Sept 28, 2014) in this Annual Report, Starbucks Corporation's Debt-to-Equity Ratio is approximately Question 9 (advertising expense). Using the 2013 data, what percent of Starbucks' total net revenue was spent on advertising? Question 10 (pricing). For the most part, Starbucks is a master of employing to maximize profits, and they use research and customer analysis to formulate targeted price increases that capture the greatest amount consumers are willing to pay without driving them off. See the next page for multiple choice options. a. Value-based pricing. b. Bundled pricing c Break-even pricing, d. Cost-based pricing