Question: 1 . 3 Regression analysis can be used to test whether the market efficiently uses information in valuing stocks. Let return be the total return

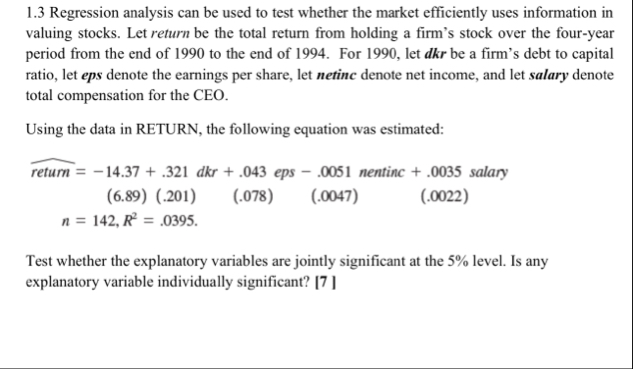

Regression analysis can be used to test whether the market efficiently uses information in valuing stocks. Let return be the total return from holding a firm's stock over the fouryear period from the end of to the end of For let be a firm's debt to capital ratio, let eps denote the earnings per share, let netinc denote net income, and let salary denote total compensation for the CEO.

Using the data in RETURN, the following equation was estimated:

widehat return eps nentinc salary

Test whether the explanatory variables are jointly significant at the level. Is any explanatory variable individually significant?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock