Question: 1. (30 points) A CNC mill was purchased 4 years ago for $60,000. Even though it is still a productive machine, a better machine is

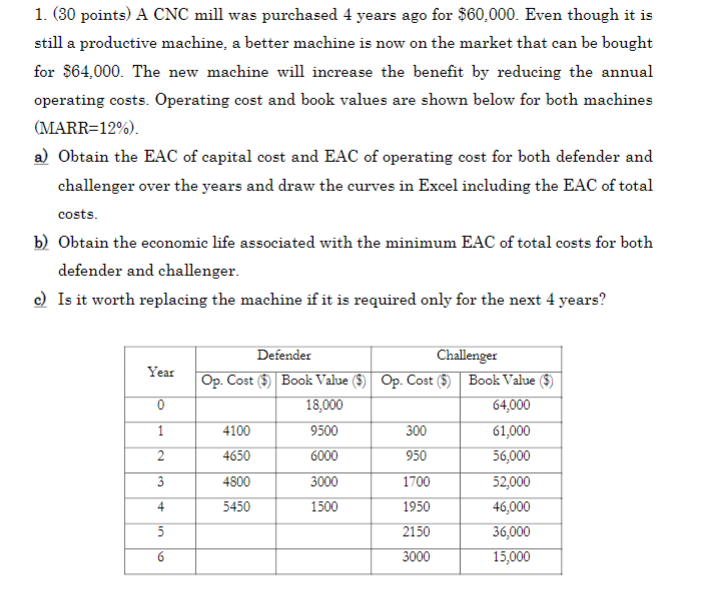

1. (30 points) A CNC mill was purchased 4 years ago for $60,000. Even though it is still a productive machine, a better machine is now on the market that can be bought for $64,000. The new machine will increase the benefit by reducing the annual operating costs. Operating cost and book values are shown below for both machines (MARR=12%). a) Obtain the EAC of capital cost and EAC of operating cost for both defender and challenger over the years and draw the curves in Excel including the EAC of total costs. b) Obtain the economic life associated with the minimum EAC of total costs for both defender and challenger. c) Is it worth replacing the machine if it is required only for the next 4 years? Year 0 1 2 2 3 Defender Challenger Op. Cost ($) Book Value (5) Op. Cost ($) Book Value ($) 18,000 64,000 4100 9500 300 61,000 4650 6000 950 56,000 4800 3000 1700 52,000 5450 1500 1950 46,000 2150 36,000 3000 15,000 3 4 5 5 6 1. (30 points) A CNC mill was purchased 4 years ago for $60,000. Even though it is still a productive machine, a better machine is now on the market that can be bought for $64,000. The new machine will increase the benefit by reducing the annual operating costs. Operating cost and book values are shown below for both machines (MARR=12%). a) Obtain the EAC of capital cost and EAC of operating cost for both defender and challenger over the years and draw the curves in Excel including the EAC of total costs. b) Obtain the economic life associated with the minimum EAC of total costs for both defender and challenger. c) Is it worth replacing the machine if it is required only for the next 4 years? Year 0 1 2 2 3 Defender Challenger Op. Cost ($) Book Value (5) Op. Cost ($) Book Value ($) 18,000 64,000 4100 9500 300 61,000 4650 6000 950 56,000 4800 3000 1700 52,000 5450 1500 1950 46,000 2150 36,000 3000 15,000 3 4 5 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts