Question: 1 E7-7 (Algo) Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO7-2, 7-3 Emily Company uses a periodic Inventory system. At

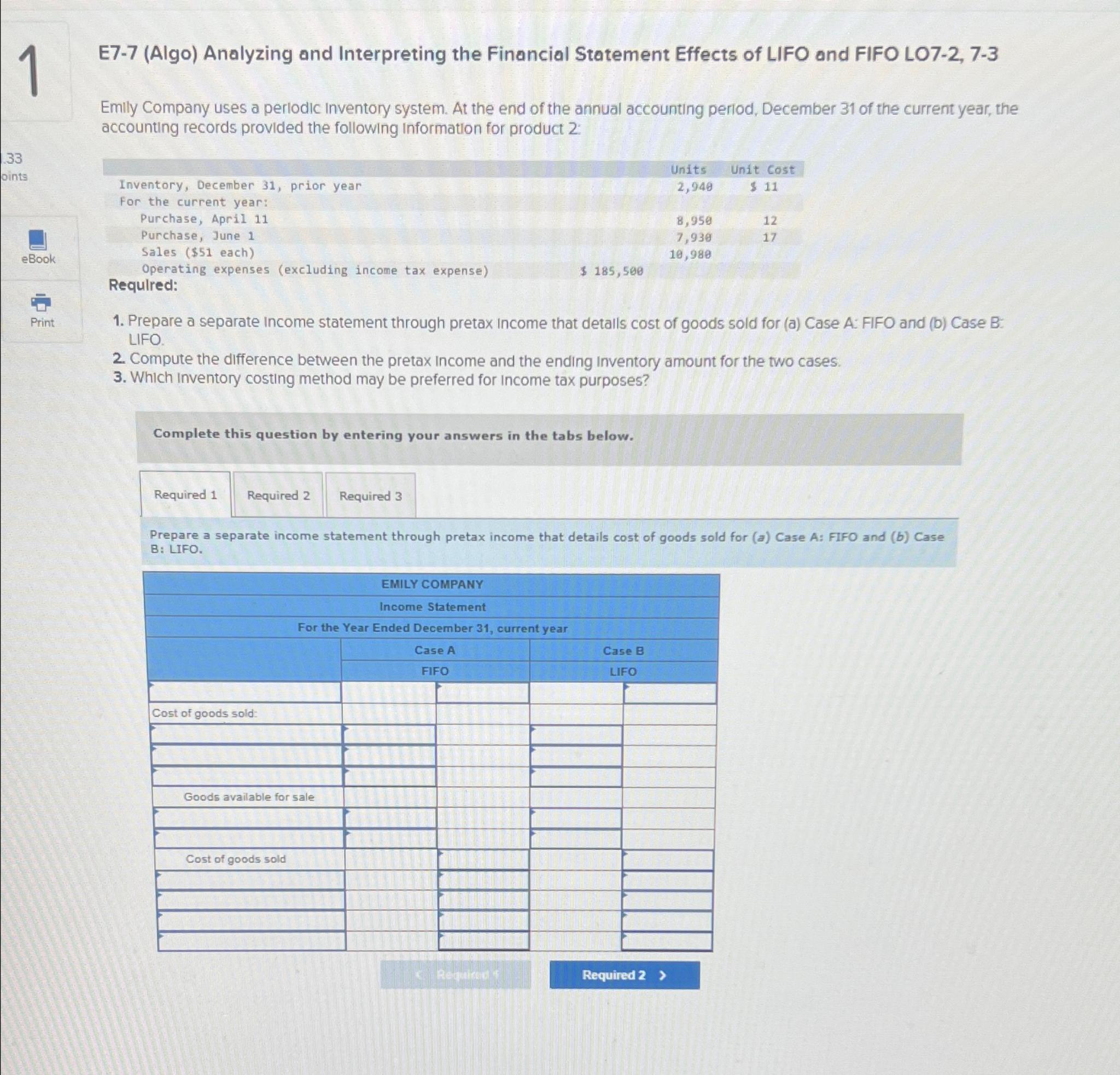

1 E7-7 (Algo) Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO7-2, 7-3 Emily Company uses a periodic Inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following Information for product 2: 33 oints eBook Print Inventory, December 31, prior year For the current year: Purchase, April 11 Purchase, June 1 Sales ($51 each) Operating expenses (excluding income tax expense) Required: Units Unit Cost 2,940 $ 11 8,950 12 7,930 17 10,980 $ 185,500 1. Prepare a separate Income statement through pretax Income that details cost of goods sold for (a) Case A: FIFO and (b) Case B: LIFO. 2. Compute the difference between the pretax Income and the ending Inventory amount for the two cases. 3. Which Inventory costing method may be preferred for Income tax purposes? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a separate income statement through pretax income that details cost of goods sold for (a) Case A: FIFO and (b) Case B: LIFO. Cost of goods sold: EMILY COMPANY Income Statement For the Year Ended December 31, current year Goods available for sale Cost of goods sold Case A FIFO Case B LIFO Required f Required 2 >

Step by Step Solution

There are 3 Steps involved in it

o compute the difference between the pretax income and the ending inventory amount for the two cases FIFO and LIFO we first need to calculate the cost ... View full answer

Get step-by-step solutions from verified subject matter experts