Question: 1 . ( 4 2 . 5 points ) Pete Corporation acquired 1 0 0 % ownership of Sue Company on January 1 , 2

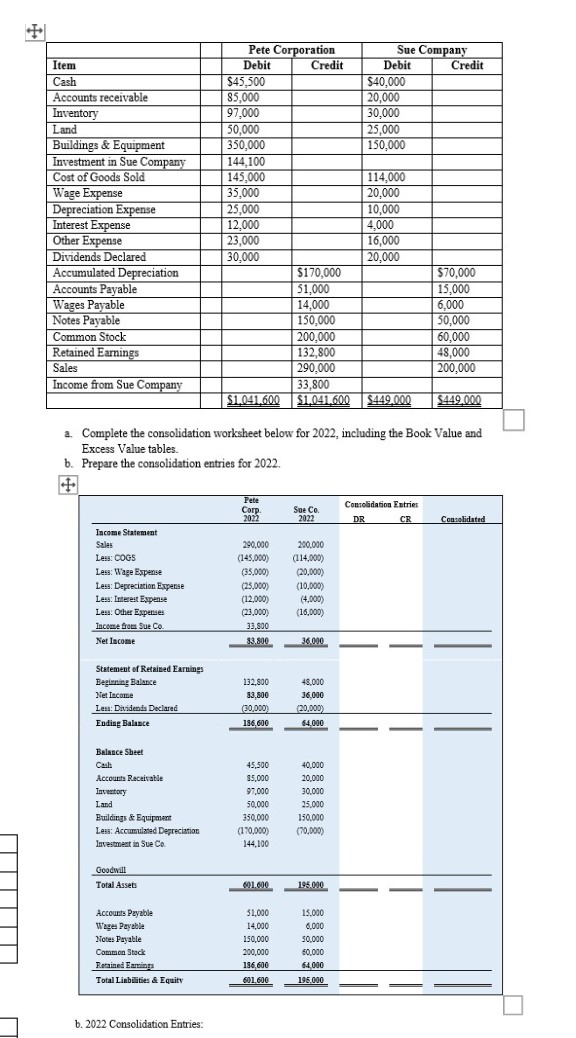

points Pete Corporation acquired ownership of Sue Company on January for $ At that date, the fair value of Sues buildings and equipment was $ more than the book value. Buildings and equipment are depreciated on a year basis; the balance of Sues accumulated depreciation was $ on the date of acquisition. Petes management concluded on December that goodwill involved in its acquisition of Sue shares had been impaired and the correct carrying value was $ Now The trial balance information for Pete and Sue for December is below in the image.. Complete the consolidation worksheet below for including the Book Value anda. Complete the consolidation worksheet below for including the Book Value and

Excess Value tables.

b Prepare the consolidation entries for

b Consolidation Entries:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock