Question: 1 . ( 4 2 . 5 points ) Pete Corporation acquired 1 0 0 % ownership of Sue Company on January 1 , 2

points Pete Corporation acquired ownership of Sue Company on January for $ At that date, the fair value of Sues buildings and equipment was $ more than the book value. Buildings and equipment are depreciated on a year basis; the balance of Sues accumulated depreciation was $ on the date of acquisition. Petes management concluded on December that goodwill involved in its acquisition of Sue shares had been impaired and the correct carrying value was $

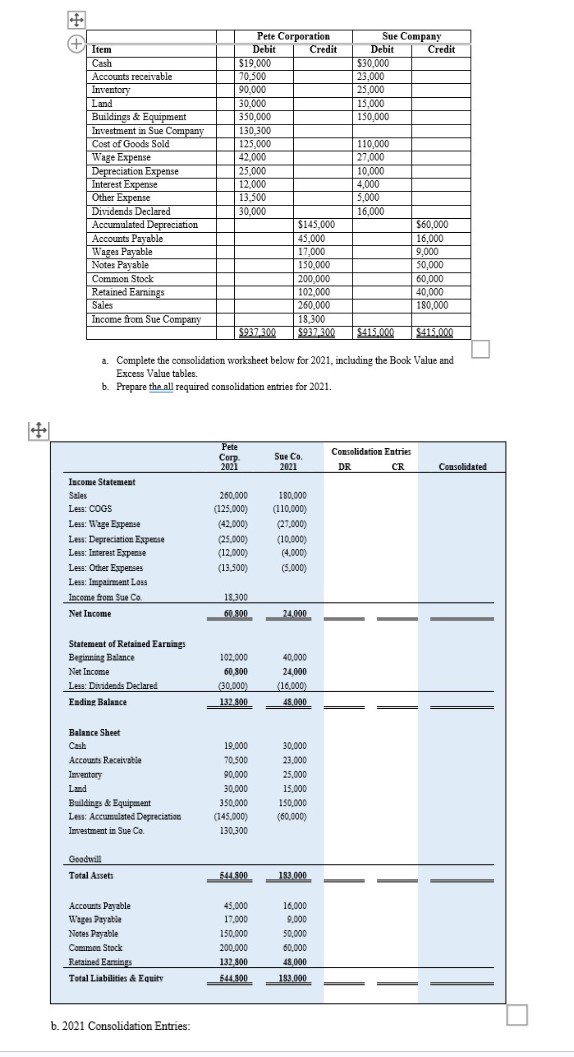

Trial balance data for Pete and Sue on December are as follows:a Complete the consolidation worksheet below for including the Book Value and

Excess Value tables.

b Prepare the all required consolidation entries for

b Consolidation Entries:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock