Question: 1. (4 points) The taking of a position which will rise in value to offset the decline in value of an existing financial position is

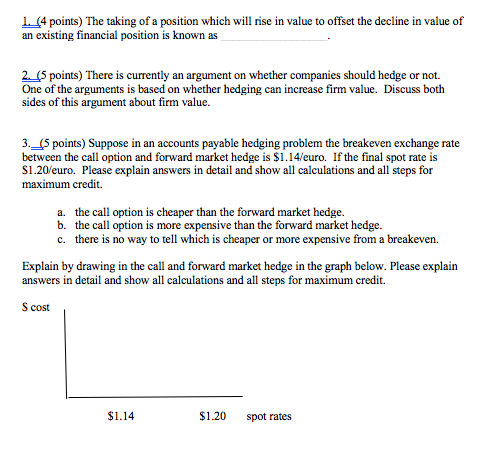

1. (4 points) The taking of a position which will rise in value to offset the decline in value of an existing financial position is known as 2. (5 points) There is currently an argument on whether companies should hedge or not. One of the arguments is based on whether hedging can increase firm value. Discuss both sides of this argument about firm value. 3. (5 points) Suppose in an accounts payable hedging problem the breakeven exchange rate between the call option and forward market hedge is $1.14/euro. If the final spot rate is $1.20/euro. Please explain answers in detail and show all calculations and all steps for maximum credit. a. the call option is cheaper than the forward market hedge. b. the call option is more expensive than the forward market hedge. c. there is no way to tell which is cheaper or more expensive from a breakeven. Explain by drawing in the call and forward market hedge in the graph below. Please explain answers in detail and show all calculations and all steps for maximum credit. S cost $1.14 $1.20 spot rates 1. (4 points) The taking of a position which will rise in value to offset the decline in value of an existing financial position is known as 2. (5 points) There is currently an argument on whether companies should hedge or not. One of the arguments is based on whether hedging can increase firm value. Discuss both sides of this argument about firm value. 3. (5 points) Suppose in an accounts payable hedging problem the breakeven exchange rate between the call option and forward market hedge is $1.14/euro. If the final spot rate is $1.20/euro. Please explain answers in detail and show all calculations and all steps for maximum credit. a. the call option is cheaper than the forward market hedge. b. the call option is more expensive than the forward market hedge. c. there is no way to tell which is cheaper or more expensive from a breakeven. Explain by drawing in the call and forward market hedge in the graph below. Please explain answers in detail and show all calculations and all steps for maximum credit. S cost $1.14 $1.20 spot rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts