Question: 1 4 TB MC Qu . 0 7 - 5 1 Under current United States tax law for consolidated... Under current United States tax law

TB MC Qu Under current United States tax law for consolidated...

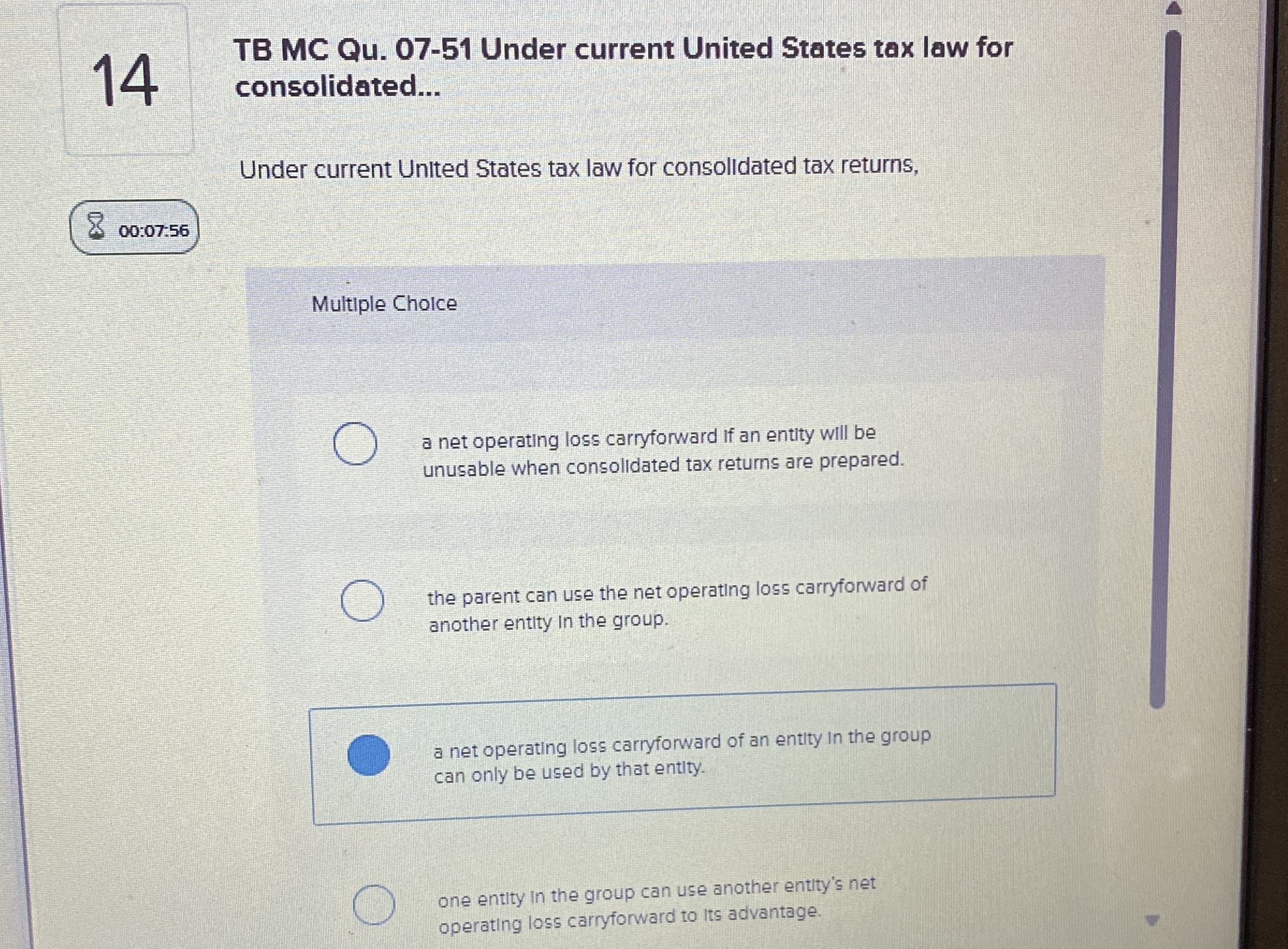

Under current United States tax law for consolidated tax returns,

::

Multiple Cholce

a net operating loss carryforward if an entity will be unusable when consolidated tax returns are prepared.

the parent can use the net operating loss carryforward of another entity in the group.

a net operating loss carryforward of an entity in the group can only be used by that entity.

one entity in the group can use another entity's net operating loss carryforward to its advantage.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock