Question: 1 4 ) Under the sales director's proposal, what would the new sales volume of dark chocolate bars be ? 1 5 ) Under the

Under the sales director's proposal, what would the new sales volume of dark chocolate bars be

Under the sales director's proposal, what would the new sales volume of dark chocolate bars be

What is the variable cost of a milk chocolate bar in s

What is the contribution of a milk chocolate bar priced at in s

What is the contribution of a dark chocolate bar if the price is increased by in s

What is the cost of milk for a fruit & nut barin s or p to two significant figures?

What is the additional cost of the fruit and nuts needed per bar s or p

Including all variable costs, what is the cost to make a fruit & nut bar?

ACFI Management Accounting Case Study

Carey M Knowles C TowersClark J Accounting A Smart Approach nd text nd Oxford: OUP

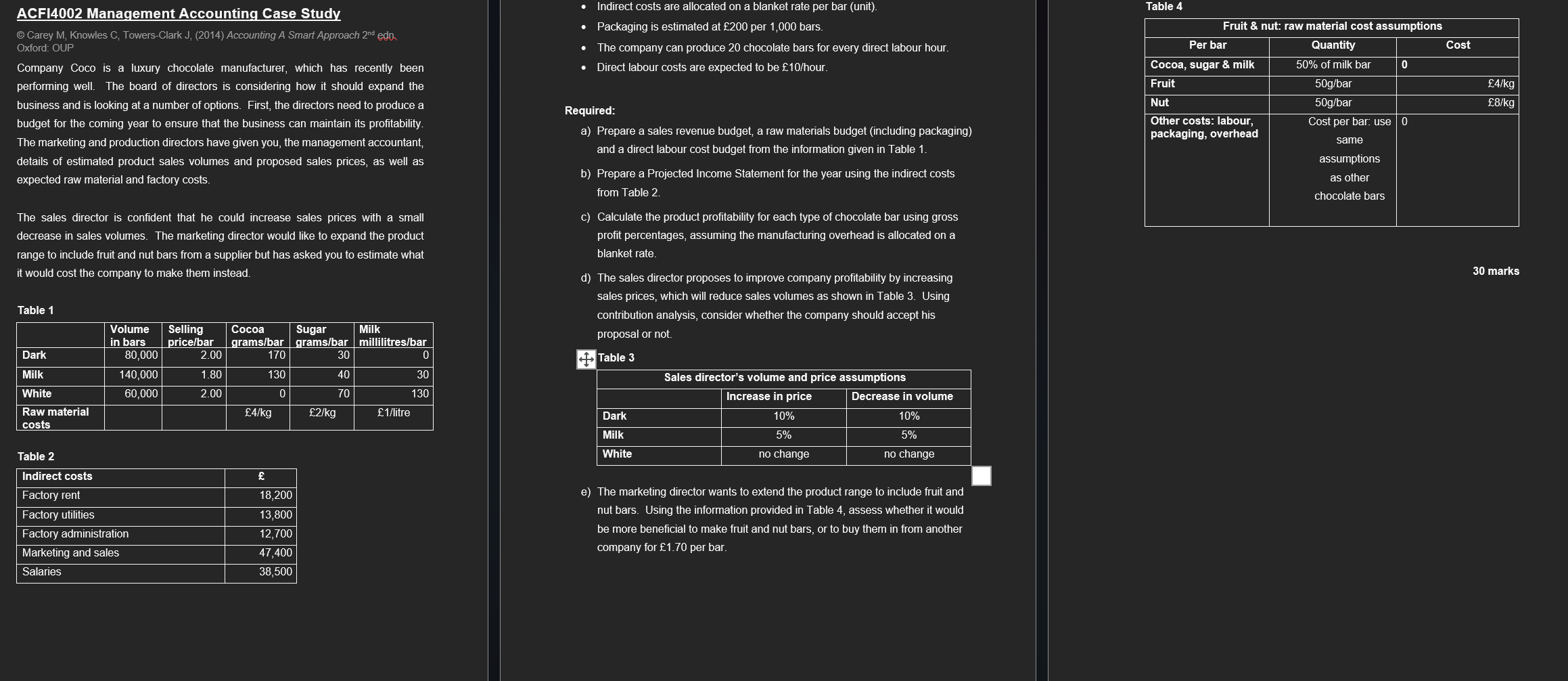

Company Coco is a luxury chocolate manufacturer, which has recently been performing well. The board of directors is considering how it should expand the business and is looking at a number of options. First, the directors need to produce a budget for the coming year to ensure that the business can maintain its profitability. The marketing and production directors have given you, the management accountant, details of estimated product sales volumes and proposed sales prices, as well as expected raw material and factory costs

The sales director is confident that he could increase sales prices with a small decrease in sales volumes. The marketing director would like to expand the product range to include fruit and nut bars from a supplier but has asked you to estimate what it would cost the company to make them instead.

Table

Table

Indirect costs are allocated on a blanket rate per bar unit

Packaging is estimated at per bars.

The company can produce chocolate bars for every direct labour hour.

Direct labour costs are expected to be hour.

Required:

a Prepare a sales revenue budget, a raw materials budget including packaging and a direct labour cost budget from the information given in Table

b Prepare a Projected Income Statement for the year using the indirect costs from Table

c Calculate the product profitability for each type of chocolate bar using gross profit percentages, assuming the manufacturing overhead is allocated on a blanket rate.

d The sales director proposes to improve company profitability by increasing sales prices, which will reduce sales volumes as shown in Table Using contribution analysis, consider whether the company should accept his proposal or not.

Table

e The marketing director wants to extend the product range to include fruit and nut bars. Using the information provided in Table assess whether it would be more beneficial to make fruit and nut bars, or to buy them in from another company for per bar.

Table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock