Question: ( $ 1 5 , 0 0 0 ) in the current year. Eighty percent of the ordinary income and all the

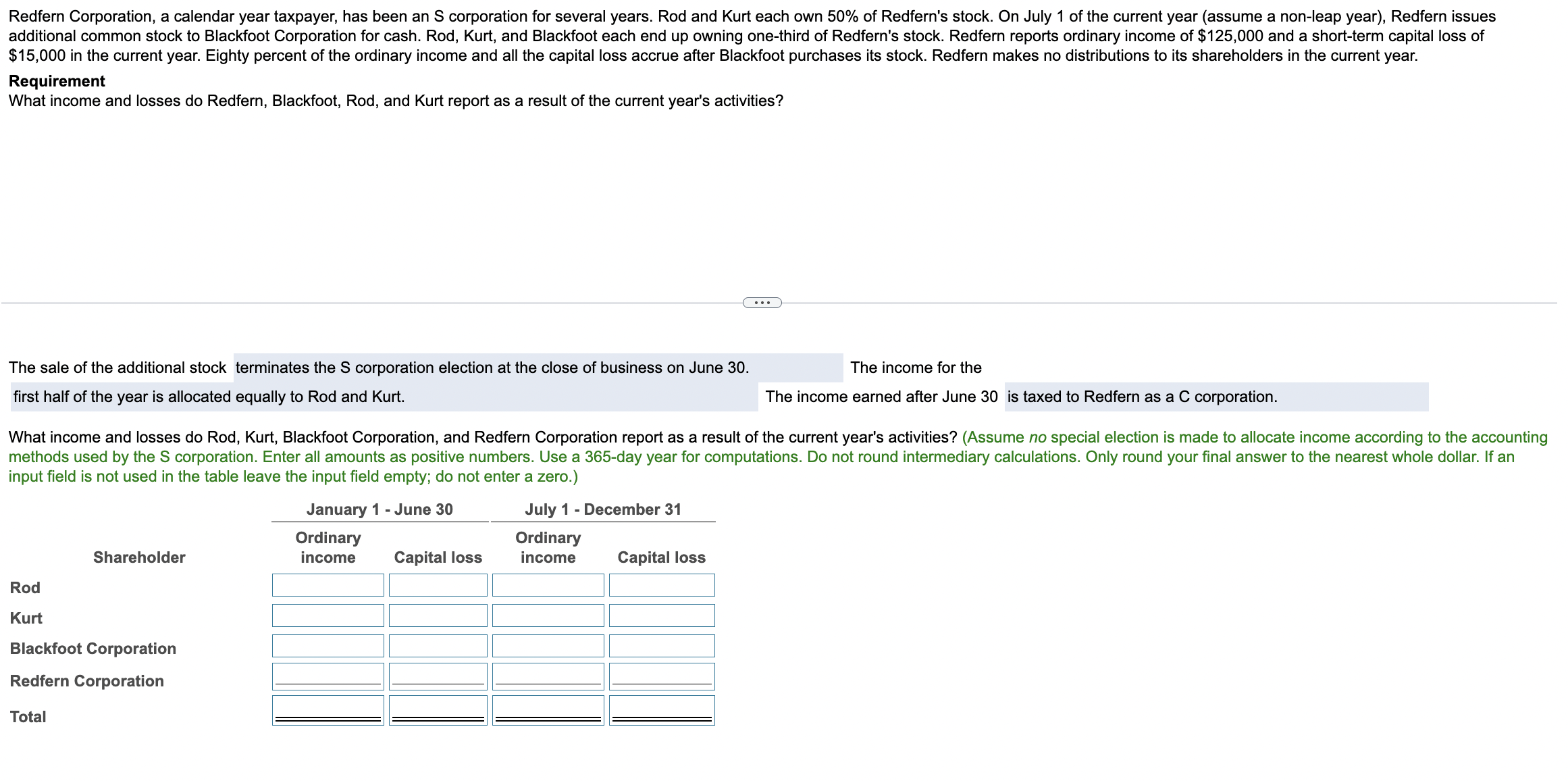

$ in the current year. Eighty percent of the ordinary income and all the capital loss accrue after Blackfoot purchases its stock. Redfern makes no distributions to its shareholders in the current year. Requirement What income and losses do Redfern, Blackfoot, Rod, and Kurt report as a result of the current year's activities? The sale of the additional stock terminates the S corporation election at the close of business on June The income for the first half of the year is allocated equally to Rod and Kurt. The income earned after June is taxed to Redfern as a C corporation. input field is not used in the table leave the input field empty; do not enter a zero.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock