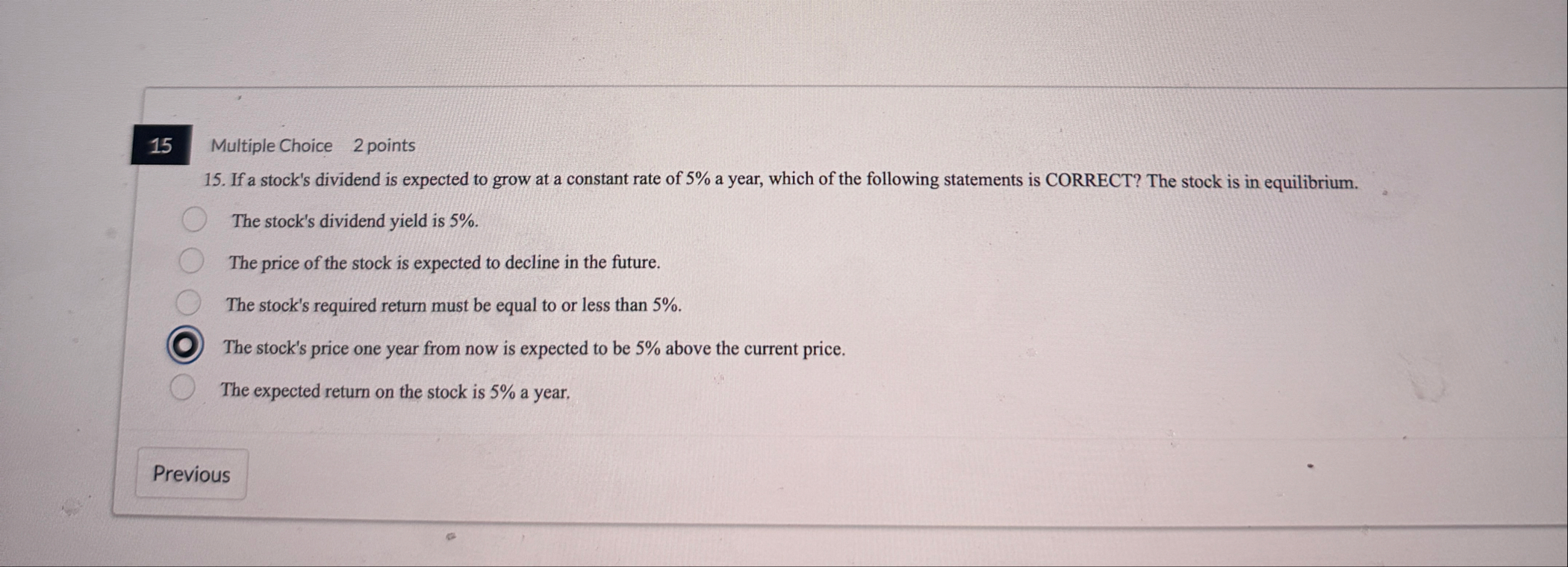

Question: 1 5 Multiple Choice 2 points 1 5 . If a stock's dividend is expected to grow at a constant rate of 5 % a

Multiple Choice points

If a stock's dividend is expected to grow at a constant rate of a year, which of the following statements is CORRECT? The stock is in equilibrium.

The stock's dividend yield is

The price of the stock is expected to decline in the future.

The stock's required return must be equal to or less than

The stock's price one year from now is expected to be above the current price.

The expected return on the stock is a year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock