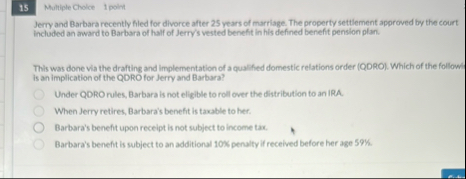

Question: 1 5 Multiple Cholce 1 point Jery and Barbara recently filed for divorce after 2 5 years of marriage. The property settlement approved by the

Multiple Cholce

point

Jery and Barbara recently filed for divorce after years of marriage. The property settlement approved by the court Included an award to Barbara of half of Jerry's vested benefit in his defined benefit pension plan.

Thls was done via the drafting and limplementation of a qualified domestic relations order QDRO Which of the followi is an implication of the QDRO for Jerry and Barbara?

Under QORO nules, Barbara is not eligible to roll over the distribution to an IRA.

When Jerry retires, Barbara's benefit is taxable to her.

Barbara's benefit upon receipt is not subject to income tax.

Barbara's benefit is subject to an additional penalty if received before her age

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock