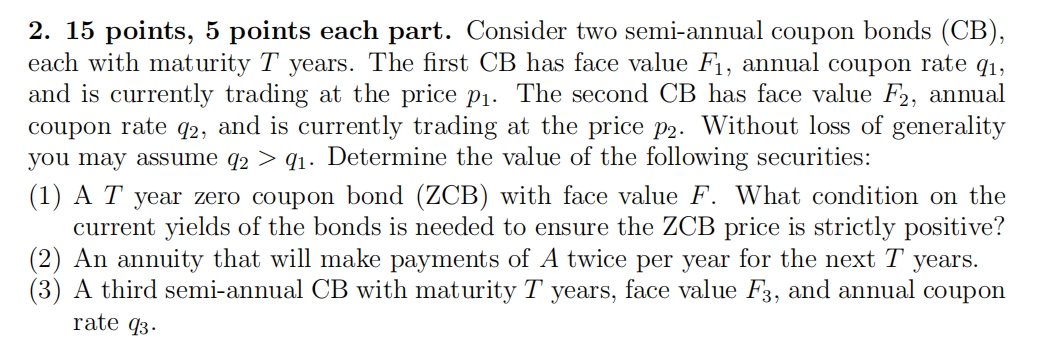

Question: 1 5 points, 5 points each part. Consider two semi - annual coupon bonds ( CB ) , each with maturity T years. The first

points, points each part. Consider two semiannual coupon bonds CB

each with maturity years. The first has face value annual coupon rate

and is currently trading at the price The second has face value annual

coupon rate and is currently trading at the price Without loss of generality

you may assume Determine the value of the following securities:

A year zero coupon bond ZCB with face value What condition on the

current yields of the bonds is needed to ensure the ZCB price is strictly positive?

An annuity that will make payments of A twice per year for the next years.

A third semiannual CB with maturity years, face value and annual coupon

rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock