Question: 1. ( 5 POINTS) Parchesi, Inc. will acquire the net assets of Scrabble, Inc. for cash. Parchesi, which has a 30% marginal tax rate, will

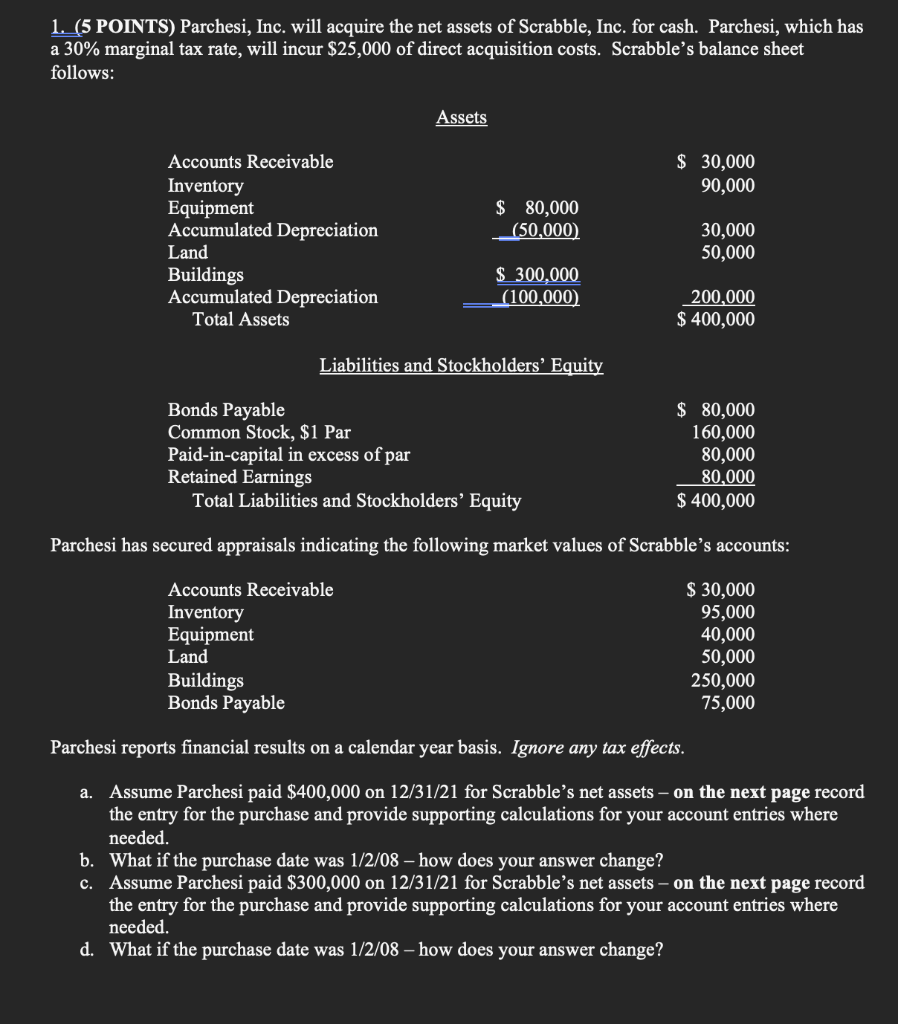

1. (5 POINTS) Parchesi, Inc. will acquire the net assets of Scrabble, Inc. for cash. Parchesi, which has a 30% marginal tax rate, will incur $25,000 of direct acquisition costs. Scrabbles balance sheet follows:

Assets

Accounts Receivable $ 30,000

Inventory 90,000

Equipment $ 80,000

Accumulated Depreciation (50,000) 30,000

Land 50,000

Buildings $ 300,000

Accumulated Depreciation (100,000) 200,000

Total Assets $ 400,000

Liabilities and Stockholders Equity

Bonds Payable $ 80,000

Common Stock, $1 Par 160,000

Paid-in-capital in excess of par 80,000

Retained Earnings 80,000

Total Liabilities and Stockholders Equity $ 400,000

Parchesi has secured appraisals indicating the following market values of Scrabbles accounts:

Accounts Receivable $ 30,000

Inventory 95,000

Equipment 40,000

Land 50,000

Buildings 250,000

Bonds Payable 75,000

Parchesi reports financial results on a calendar year basis. Ignore any tax effects.

A) Assume Parchesi paid $400,000 on 12/31/21 for Scrabbles net assets on the next page record the entry for the purchase and provide supporting calculations for your account entries where needed.

B) What if the purchase date was 1/2/08 how does your answer change?

C) Assume Parchesi paid $300,000 on 12/31/21 for Scrabbles net assets on the next page record the entry for the purchase and provide supporting calculations for your account entries where needed.

D) What if the purchase date was 1/2/08 how does your answer change?

1. (5 POINTS) Parchesi, Inc. will acquire the net assets of Scrabble, Inc. for cash. Parchesi, which has a 30% marginal tax rate, will incur $25,000 of direct acquisition costs. Scrabble's balance sheet follows: Liabilities and Stockholders' Equity Parchesi has secured appraisals indicating the following market values of Scrabble's accounts: Parchesi reports financial results on a calendar year basis. Ignore any tax effects. a. Assume Parchesi paid $400,000 on 12/31/21 for Scrabble's net assets - on the next page record the entry for the purchase and provide supporting calculations for your account entries where needed. b. What if the purchase date was 1/2/08 - how does your answer change? c. Assume Parchesi paid $300,000 on 12/31/21 for Scrabble's net assets - on the next page record the entry for the purchase and provide supporting calculations for your account entries where needed. d. What if the purchase date was 1/2/08 - how does your answer change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts