Question: 1 5 Using a one - step binomial model, calculate the risk neutral probability of an up move , given a risk - free rate

Using a onestep binomial model, calculate the risk neutral probability of an up move given a riskfree rate of and up factor of and a down factor of for an option expiring in six months.

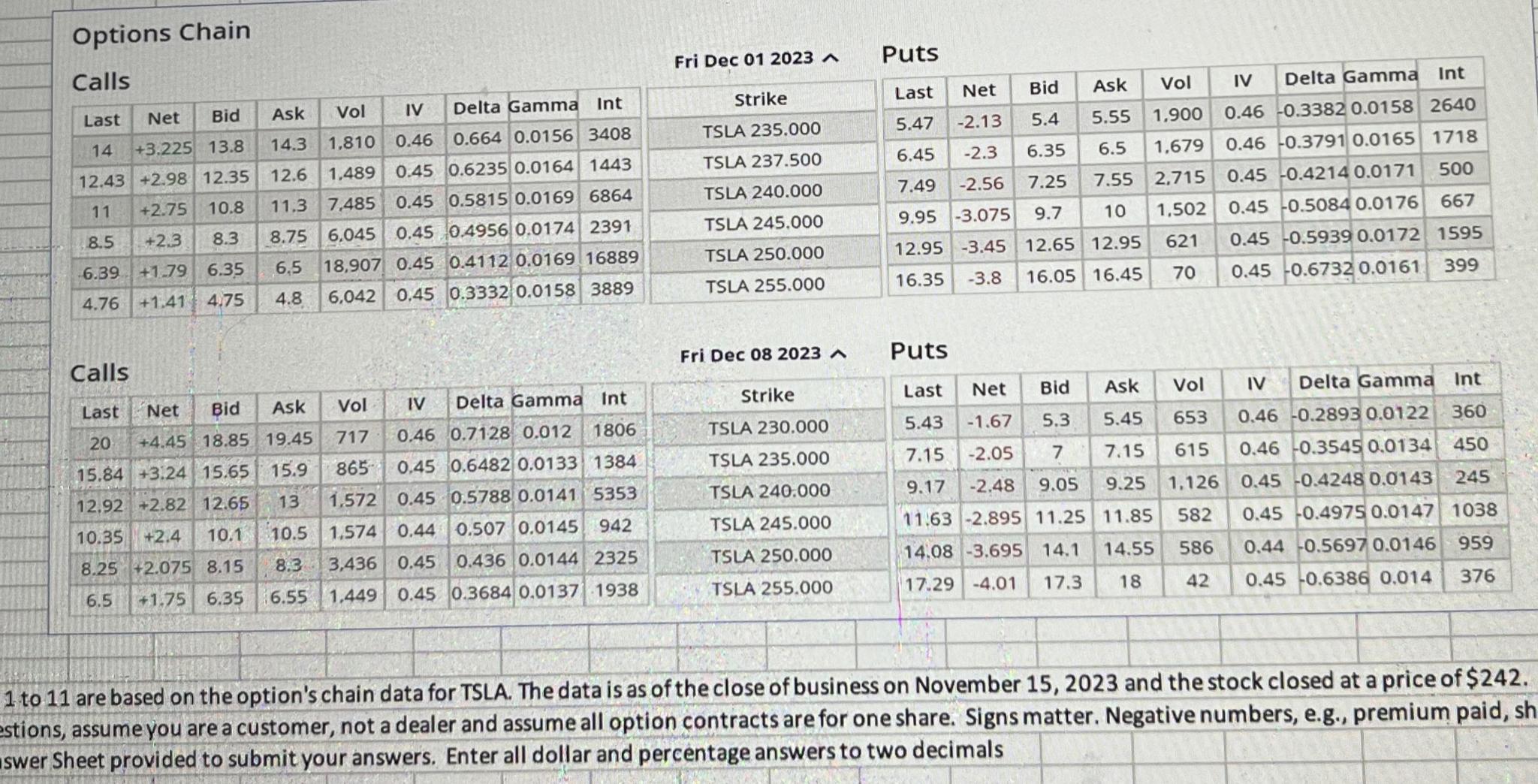

Using the information from the previous question calculate the value of a six moth call struck at $ assuming the stock is currently trading at $

Assume NFLX is currently trading at $ A nine month call option, stuck at $ is available for $ What is the time value of this call option?

Assume prices on the S&P are normally distributed with a mean of index points and an standard deviation of index points. What is the probability that the S&P fall below over next year?

Assume the probability of the stock market rising in any given year can be modelled as a binomial distribution, and is What is the probability that the stock market rises or times during the next twenty years?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock