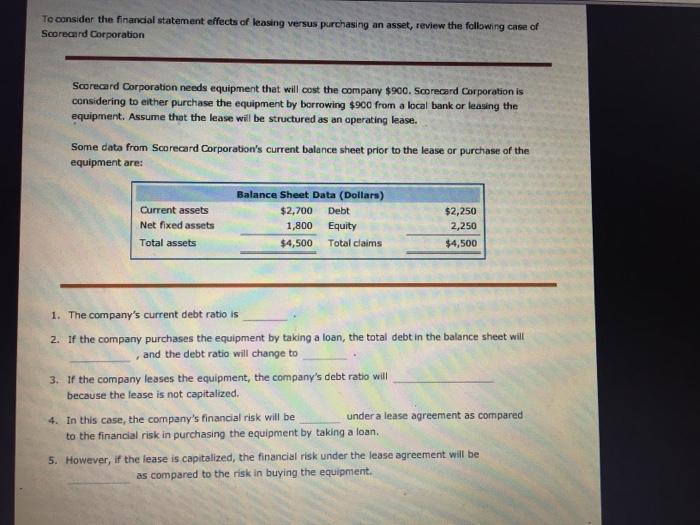

Question: 1. 50%, 40%, 83%, 100% 2.increase/decrease, 42%, 58%, 117%, 70% 3. decrease/increase/remain unchanged 4. more/less 5. more/the same 15. Effects of leasing on financial statements

1. 50%, 40%, 83%, 100%

2.increase/decrease, 42%, 58%, 117%, 70%

3. decrease/increase/remain unchanged

4. more/less

5. more/the same

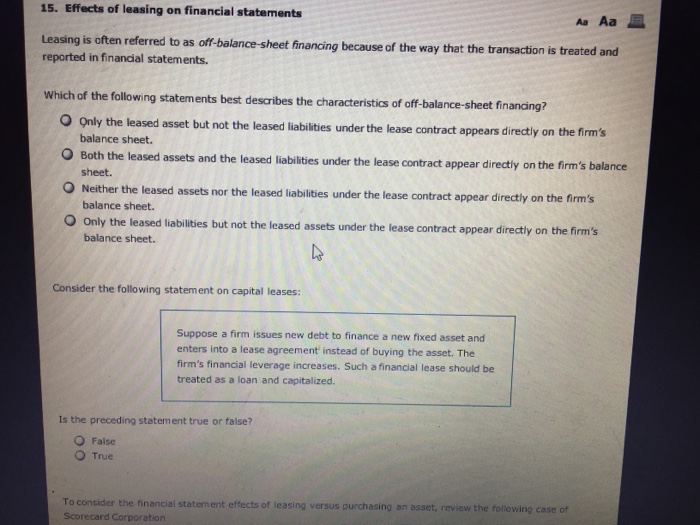

15. Effects of leasing on financial statements Aa Aa Leasing is often referred to as off- balance-sheet financing because of the way that the transaction is treated and reported in financial statements Which of the following statements best describes the characteristics of off-balance-sheet finanding? O Only the leased asset but not the leased liabilities under the lease contract appears diredtly on the frm's O Both the leased assets and the leased liabilities under the lease contract appear directly on the firm's balance O Neither the leased assets nor the leased liabilities under the lease contract appear directly on the firms O Only the leased liab balance sheet. sheet. balance sheet. bilities but not the leased assets under the lease contract appear directly on the firm's balance sheet. Consider the following statement on capital leases: Suppose a firm issues new debt to finance a new fixed asset and enters into a lease agreement instead of buying the asset. The firm's financial leverage increases. Such a financial lease should be treated as a loan and capitalized. Is the preceding statement true or false? O False O True To consider the financial statement effects of leasing versus purchasing an asset, review the following case of Scorecard Corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts