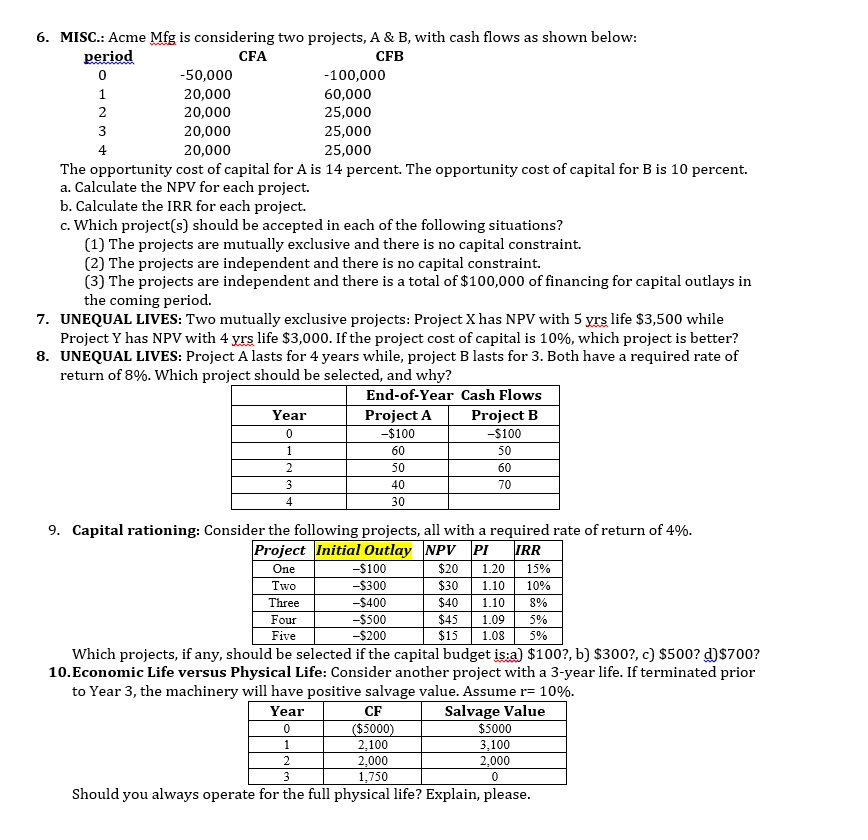

Question: 1 6. MISC.: Acme Mfg is considering two projects, A & B, with cash flows as shown below: period CFA CFB 0 -50,000 -100,000 20,000

1 6. MISC.: Acme Mfg is considering two projects, A & B, with cash flows as shown below: period CFA CFB 0 -50,000 -100,000 20,000 60,000 2 20,000 25,000 3 20,000 25,000 4 20,000 25,000 The opportunity cost of capital for A is 14 percent. The opportunity cost of capital for B is 10 percent. a. Calculate the NPV for each project. b. Calculate the IRR for each project. c. Which project(s) should be accepted in each of the following situations? (1) The projects are mutually exclusive and there is no capital constraint. (2) The projects are independent and there is no capital constraint. (3) The projects are independent and there is a total of $100,000 of financing for capital outlays in the coming period. 7. UNEQUAL LIVES: Two mutually exclusive projects: Project X has NPV with 5 yrs life $3,500 while Project Y has NPV with 4 yrs life $3,000. If the project cost of capital is 10%, which project is better? 8. UNEQUAL LIVES: Project A lasts for 4 years while, project B lasts for 3. Both have a required rate of return of 8%. Which project should be selected, and why? End-of-Year Cash Flows Year Project A Project B -$100 -$100 0 2 60 50 40 30 50 60 70 4 9. Capital rationing: Consider the following projects, all with a required rate of return of 4%. Project Initial Outlay NPV PI IRR One -$100 $20 1.20 15% Two -$300 $30 1.10 10% Three -$400 $40 1.10 8% Four -$500 $45 1.09 5% Five -$200 $15 1.08 5% Which projects, if any, should be selected if the capital budget is:a) $100?, b) $300?, c) $500? d)$700? 10.Economic Life versus Physical Life: Consider another project with a 3-year life. If terminated prior to Year 3, the machinery will have positive salvage value. Assume r= 10%. Year CF Salvage Value 0 ($5000) $5000 2,100 3.100 2 2,000 2,000 3 1,750 Should you always operate for the full physical life? Explain, please. 1 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts