Question: 1 . ( 7 0 pts ) You are back in the world of ice cream, now working for a berry farmer who supplies berries

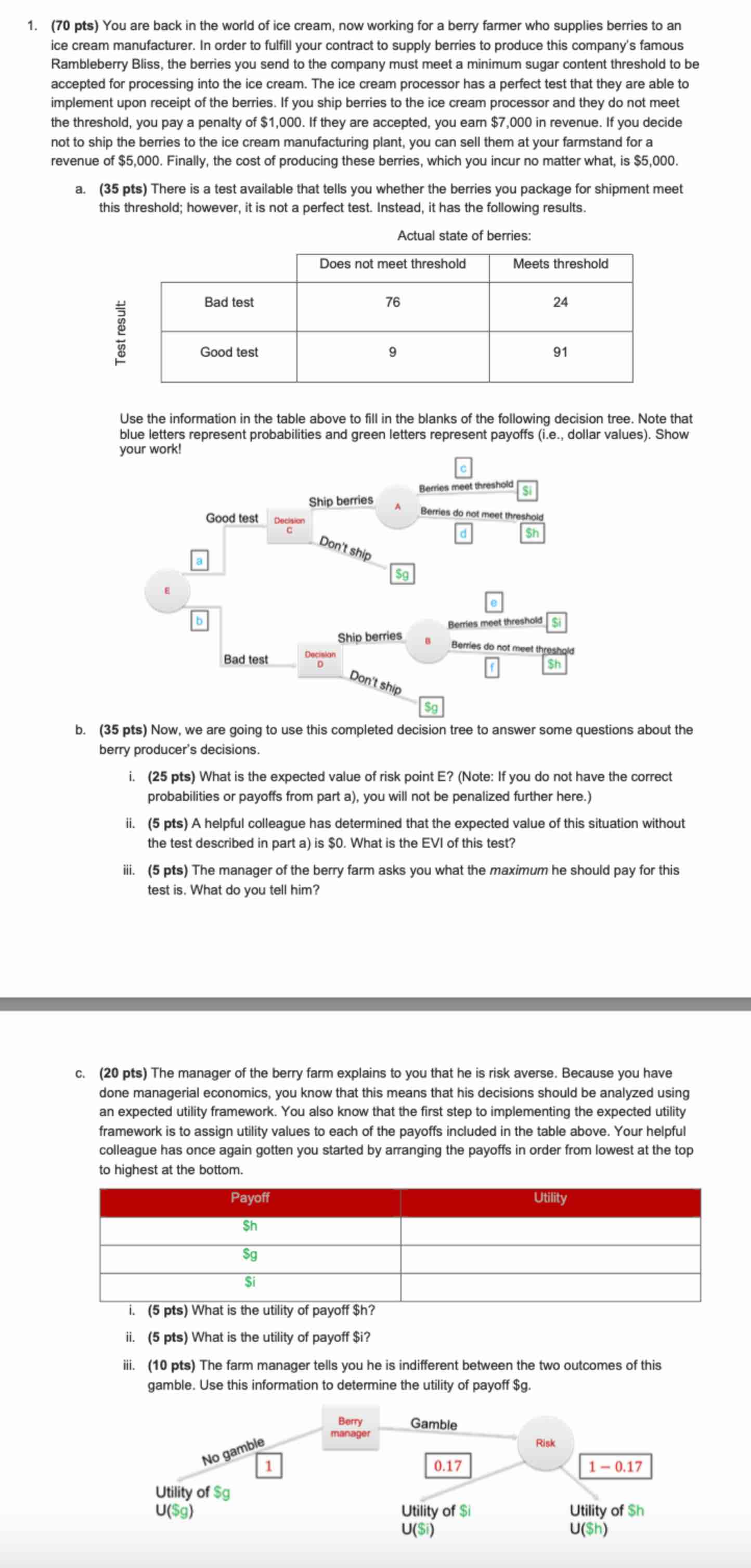

pts You are back in the world of ice cream, now working for a berry farmer who supplies berries to an ice cream manufacturer. In order to fulfill your contract to supply berries to produce this company's famous Rambleberry Bliss, the berries you send to the company must meet a minimum sugar content threshold to be accepted for processing into the ice cream. The ice cream processor has a perfect test that they are able to implement upon receipt of the berries. If you ship berries to the ice cream processor and they do not meet the threshold, you pay a penalty of $ If they are accepted, you earn $ in revenue. If you decide not to ship the berries to the ice cream manufacturing plant, you can sell them at your farmstand for a revenue of $ Finally, the cost of producing these berries, which you incur no matter what, is $

a pts There is a test available that tells you whether the berries you package for shipment meet this threshold; however, it is not a perfect test. Instead, it has the following results.

Actual state of berries:

Use the information in the table above to fill in the blanks of the following decision tree. Note that blue letters represent probabilities and green letters represent payoffs ie dollar values Show your work!

b pts Now, we are going to use this completed decision tree to answer some questions about the berry producer's decisions.

i pts What is the expected value of risk point E Note: If you do not have the correct probabilities or payoffs from part a you will not be penalized further here.

ii pts A helpful colleague has determined that the expected value of this situation without the test described in part a is $ What is the EVI of this test?

iii. pts The manager of the berry farm asks you what the maximum he should pay for this test is What do you tell him?

c pts The manager of the berry farm explains to you that he is risk averse. Because you have done managerial economics, you know that this means that his decisions should be analyzed using an expected utility framework. You also know that the first step to implementing the expected utility framework is to assign utility values to each of the payoffs included in the table above. Your helpful colleague has once again gotten you started by arranging the payoffs in order from lowest at the top to highest at the bottom.

imathbfp t s What is the utility of payoff $ mathrm~h

ii pts What is the utility of payoff $ mathrmi

iii. mathbfmathbf~ p t s ~ T h e ~ f a r m ~ m a n a g e r ~ t e l l s ~ y o u ~ h e ~ i s ~ i n d i f f e r e n t ~ b e t w e e n ~ t h e ~ t w o ~ o u t c o m e s ~ o f ~ t h i s ~ gamble. Use this information to determine the utility of payoff $ mathrm~g

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock