Question: 1 7 2 0 1 7 Multiple Choice 5 points Which if the following is EALSE regarding options and futures? A long call option gives

Multiple Choice

points

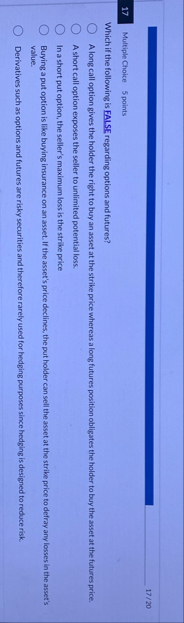

Which if the following is EALSE regarding options and futures?

A long call option gives the holder the right to buy an asset at the strike price whereas a long futures position obligates the holder to buy the asset at the futures price.

A short call option exposes the seller to unlimited potential loss.

In a short put option, the seller's maximum loss is the strike price

Buying a put option is like buying insurance on an asset. If the asset's price declines, the put holder can sell the asset at the strike price to defray any losses in the asset's value.

Derivatives such as options and futures are risky securities and therefore rarely used for hedging purposes since hedging is designed to reduce risk.

Multiple Choice

points

Which if the following is EALSE regarding options and futures?

A long call option gives the holder the right to buy an asset at the strike price whereas a long futures position obligates the holder to buy the asset at the futures price.

A short call option exposes the seller to unlimited potential loss.

In a short put option, the seller's maximum loss is the strike price

Buying a put option is like buying insurance on an asset. If the asset's price declines, the put holder can sell the asset at the strike price to defray any losses in the asset's value.

Derivatives such as options and futures are risky securities and therefore rarely used for hedging purposes since hedging is designed to reduce risk.

Multiple Choice

points

Which if the following is EALSE regarding options and futures?

A long call option gives the holder the right to buy an asset at the strike price whereas a long futures position obligates the holder to buy the asset at the futures price.

A short call option exposes the seller to unlimited potential loss.

In a short put option, the seller's maximum loss is the strike price

Buying a put option is like buying insurance on an asset. If the asset's price declines, the put holder can sell the asset at the strike price to defray any losses in the asset's value.

Derivatives such as options and futures are risky securities and therefore rarely used for hedging purposes since hedging is designed to reduce risk.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock